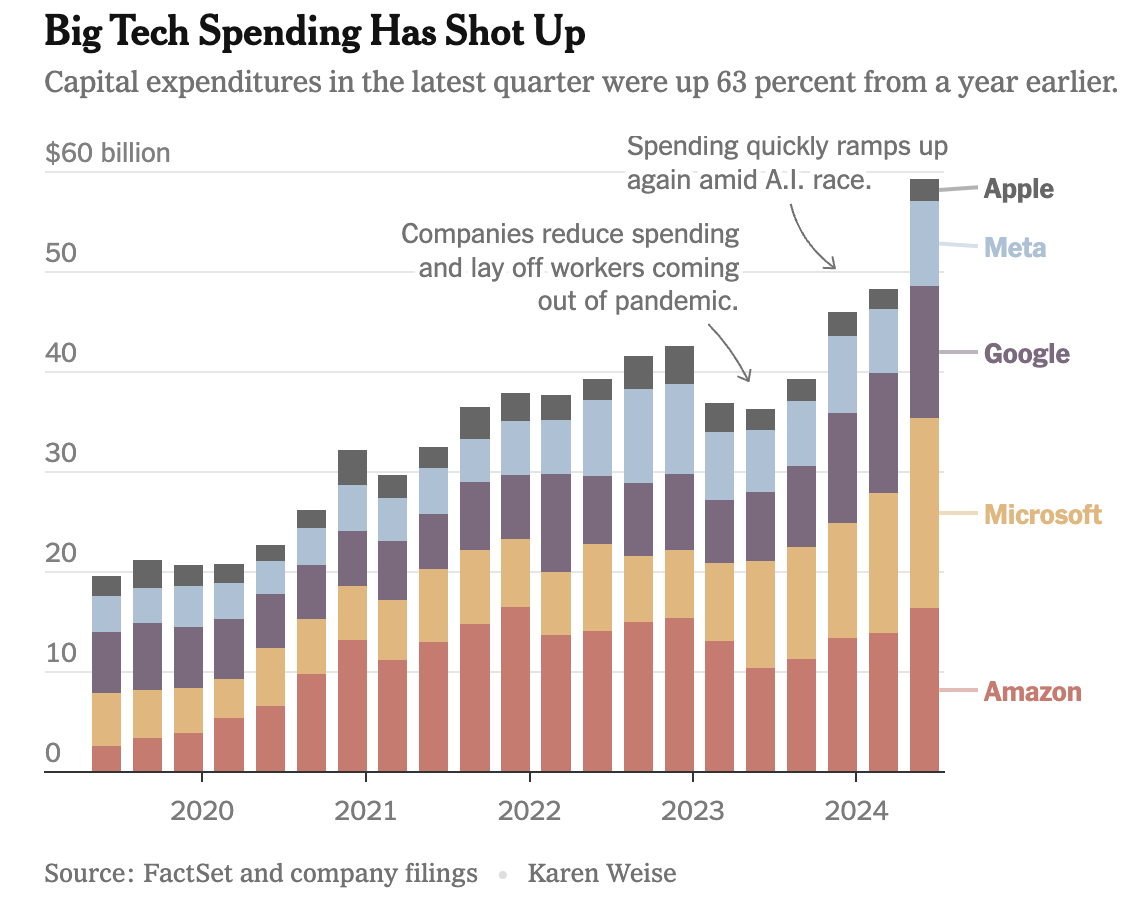

Big Tech’s massive investments in AI-related infrastructure aren’t just sustaining their own growth — these incumbents are paving the way for the next wave of startups delivering disruptive innovation. While pundits marvel at and question the wisdom of Microsoft, Google, Amazon, Meta, and Apple’s combined $60 billion in second quarter capital expenditures, it is creating unprecedented opportunities for emerging startups. These GenAI-native “Next Tech” startups are now empowered to experiment and innovate in Applied AI thanks to Big Tech’s massive commitments.

Big Tech leaders believe the risk of under-investment in AI infrastructure is greater than over-investment. But, while Big Tech works to sustain their advantage in cloud computing and AI, their investments are also enabling Next Tech startups to push the boundaries of innovation. The availability of cloud infrastructure and cutting-edge AI models offers startups the opportunity to build on these foundations. So, on behalf of all startups, thank you, Big Tech, for investing big!

How Next Tech Benefits from Big Tech’s Investments

Next Tech emerging companies are a clear beneficiary of these investments for three core reasons:

- Access to Capital: Next Tech generally CAN’T attract the magnitude of capital required to make the infrastructure and frontier model investments Big Tech can.

- Infrastructure Operations: Next Tech generally CAN’T operate the core infrastructure and associated large models necessary for the design, build, test, and deployment of Applied AI solutions.

- Focus on Innovation: Next Tech CAN build new layers of value capture (abstractions) that work on top of and across existing applications, data sources, models, and infrastructure to create the next truly disruptive products and companies.

Big Tech is not sitting still. They are leveraging their scale, capital, data access, and AI experience to build on existing products and workflows that have resonated with customers for years. Many of these copilots and enhancements will succeed in the short to medium term at the infrastructure and application layers. But, most Big Tech companies are primarily progressing along a Clayton Christian-style path of sustaining innovation. While incumbents can succeed with an applied AI-sustaining innovation strategy, the most disruptive innovations will likely come from nimble startups.

Standing on the Shoulders of Giants

In every era of tech, the next big breakthrough companies have been those leveraging the transformative technologies that came before. The next wave of disruption stands on the technology shoulders of giants. And, this leads to new winners emerging.

Components of mainframes gave rise to the mini-computer and portable operating systems, which led to the PCs and eventually to the commercial Internet, SaaS, cloud, and mobile. While machine learning has been around for decades, today, we are witnessing the early days of the generative AI transformation — a revolution building upon decades of tech advancements.

In this emerging era of GenAI, an initial cohort of companies, including OpenAI, Anthropic, HuggingFace, and Scale AI, are already showing promise. Each leverages incumbents as investors, distribution partners and/or customers. But, the enduring Next Tech winners in Applied AI — especially at the middleware and application/agentic layers — are far from clear. We are seeing unprecedented experimentation with the technology and associated business models, so it will take time for enduring winners to emerge.

Most Next Tech startups, excluding those few with substantial investment and support from Big Tech, will find winning at the infrastructure and core model layers challenging. Next Tech winners are more likely to emerge at the application/agentic and middleware/enablers layers of the AI stack. This will happen specifically at points of aggregation across a mix of unstructured and structured data sources, workflows, and end-user interactions/modalities (voice, vision, text, 3-D). While it may appear that Big Tech incumbents are prevailing in this major industry shift, the most transformative winners in Applied AI will come from Next Tech, “gen native” companies that pursue truly novel approaches unencumbered by existing products, business models, and company mindsets.

The Incumbent’s Advantage

Before I leave the incumbents behind — it is important to acknowledge that these companies will benefit as more enterprises need greater AI infrastructure, models, and application expertise. Incumbents have formidable advantages when it comes to applied AI transformations.

Customer Relationships and Workflows: Big Tech companies at the infrastructure and application layers have worked with customers of all sizes for years. They have the company-specific, functional, and often domain context for these customers and can leverage that to build use-case-specific models that solve real-world customer problems.

Access to Data: Beyond the workflows is the data. Every customer, especially larger customers, has established repeatable patterns for creating “mixed structured” information, including writing code, internal communications, external communications, brand assets, contracts, sales presentations, and so much more. With the generative AI ecosystem’s ability to leverage these diversely structured forms of data to train, fine-tune, or augment base models, substantial productivity gains can be achieved.

Top AI and Data Talent: Incumbents have other near-term advantages in AI/data science and data management talent and capabilities. Their capital resources and the scale/scope of projects they can take on are compelling to attract and retain top talent. Well before generative AI, these incumbents were working at scale with data, data science, and deployed “intelligent applications” — Google search, Facebook content matching, Amazon shopping, and Apple facial recognition to name a few. This combination of talent and know-how will prove immensely helpful to the incumbents.

Operational Expertise: Building data centers is likely to get more challenging as access to cost-effective and sufficiently scalable energy, power/cooling systems, data centers, and computing equipment persists. Moreover, it is not enough to build AI-forward data centers; they have to be operated reliably and at scale. Here again, the incumbent companies have the know-how to succeed.

These Big Tech incumbents also have customer trust and digital connectivity through APIs, authentication services, and security/governance compliance. This could be even more important when data and “predictive” (vs deterministic) models are deployed in production. These advantages are substantial and will help the incumbents be the early market leaders in applied AI.

Big Tech’s advantages can also be their vulnerabilities in the long term. These risks included a focus on structured/deterministic data and workflows and their need to mitigate the risk of cannibalizing existing revenue. Incumbents tend to be less nimble when faced with disruptive technologies. And, in this cycle particularly, the incumbents are trying to move out of their “swim lanes” to capture more of the GenAI prize!

Why Next Tech Will Lead in Disruption

In the context of Big Tech’s strengths, Next Tech startups are taking a “first principled” approach with customers to unlock novel opportunities for applied AI and leveraging the infrastructure, frontier models, and services Big Tech offers! While Big Tech must focus on maintaining existing products and revenue streams, startups are free to pursue disruptive innovation in product capabilities, pricing, and business models and emerge as success stories from the Applied AI transformation.

Big Tech’s CapEx investment advantage unlocks data center and model resources, allowing Next Tech startups to gain access to frontier models they can largely pay for “as they go.” With competition in the AI model space increasing — thanks to open models like LLaMA, Claude, and Mistral — Next Tech can leverage frontier models more cost-effectively than ever. In addition, we are already seeing start-ups work across traditional structured workflow and data silos to build new forms of aggregation and automation value for end customers. We will share more of these examples as they more fully establish their differentiation and market leadership.

Next Tech’s disruptive potential is not limited to core products. There is also a significant opportunity for innovation in business models. (I previously wrote about AI business models here.) Beyond the traditional subscription and consumption-like models outlined in that post, two other trends are emerging.

- “Buy Side” Monetization: The practice of direct end-user adoption and purchasing for innovative solutions grew in the SaaS/subscription era, but it is likely to expand further as buy-side “agents” working on behalf of end customers emerge.

- Automation of Services: AI agents and associated workflows will capture a greater share of external and internal services revenue as they automate processes that used to be far more “human-powered” and monetized via professional services or employee expenses. This trend allows startups to initially focus on specific problems in complement with service providers and then expand their market over time.

The Future Is Bright for Next Tech

Admittedly, my “crystal ball” around how Next Tech startups win in the medium to long term is cloudy. Just as Microsoft, Apple, and IBM have found ways to sustain category leadership over the decades, some incumbents will become market leaders in the categories of applied AI over the next decade. However, I am equally confident that there will be major new winners, especially in intelligent application/agents categories, that have probably not emerged yet. Some compelling companies like Glean, Codium, Writer, Read AI are emerging as intelligent application contenders, but no Gen-native company has emerged yet as a sustainable market leader.

I believe that when we look back, the Next Tech winners will have stood on the shoulders of giants and built new products, solutions, and business models to leverage the past while solving customer problems better for the future. If that predictions prove true, the Next Tech winners should at least thank the incumbents like Microsoft, Google, Amazon, and Meta that helped them reach new heights!