Only five years ago, the autonomous vehicle future seemed like a distant vision.

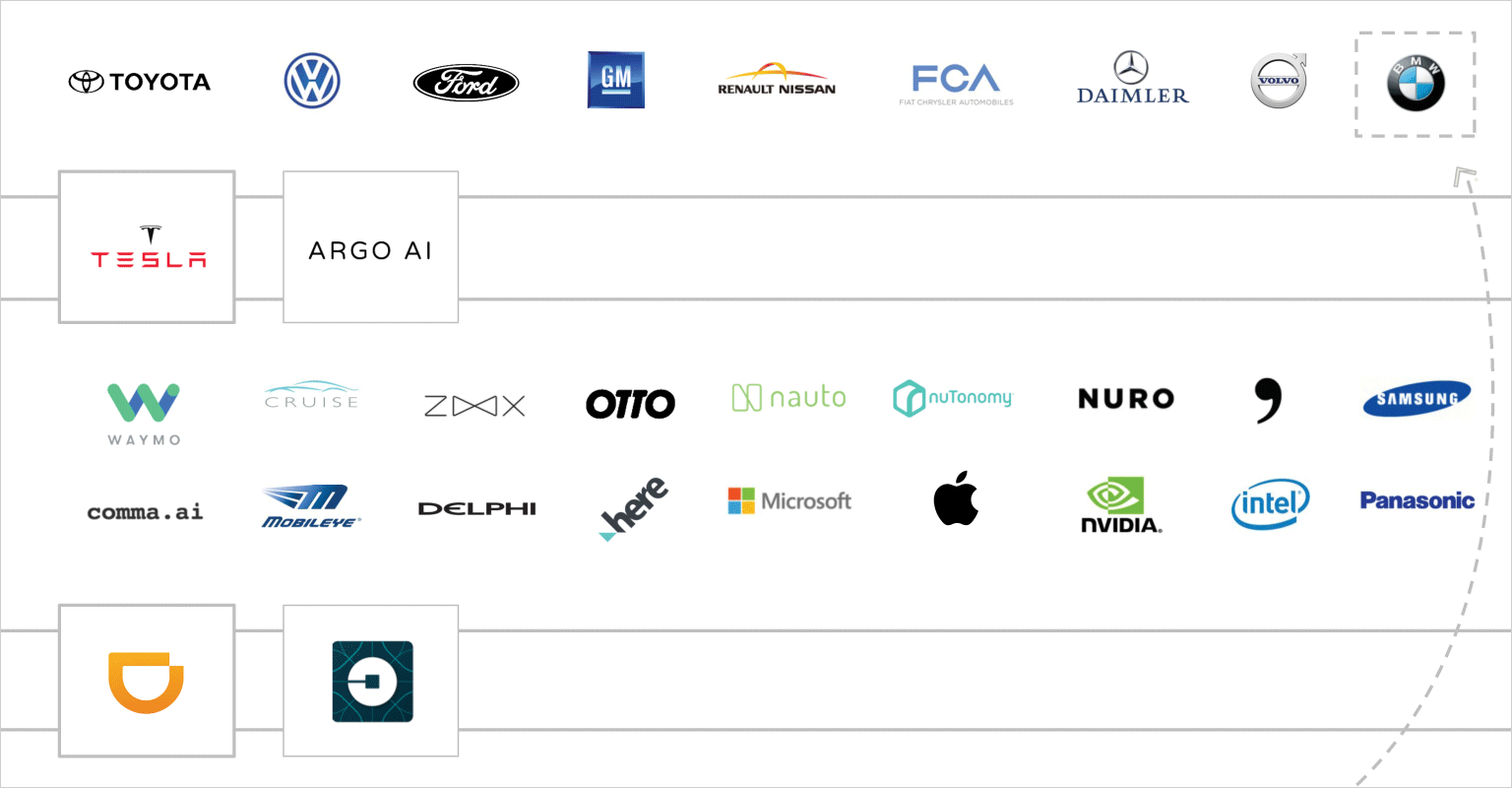

This year at CES, the “frenzy” over autonomous vehicles stole the show with dozens of live demos, partnerships, and product announcements. In fact, 13 of the world’s 14 largest automakers have announced plans to bring autonomous vehicles to market, and 12 of the world’s 14 largest technology companies have announced plans to build technologies to support and operate autonomous vehicles.

This sudden interest in autonomous driving has bid up the “going rate” for autonomous driving talent to, at least in one case, $10 million per person (Harvard, MIT, CMU, and Stanford students take note!)

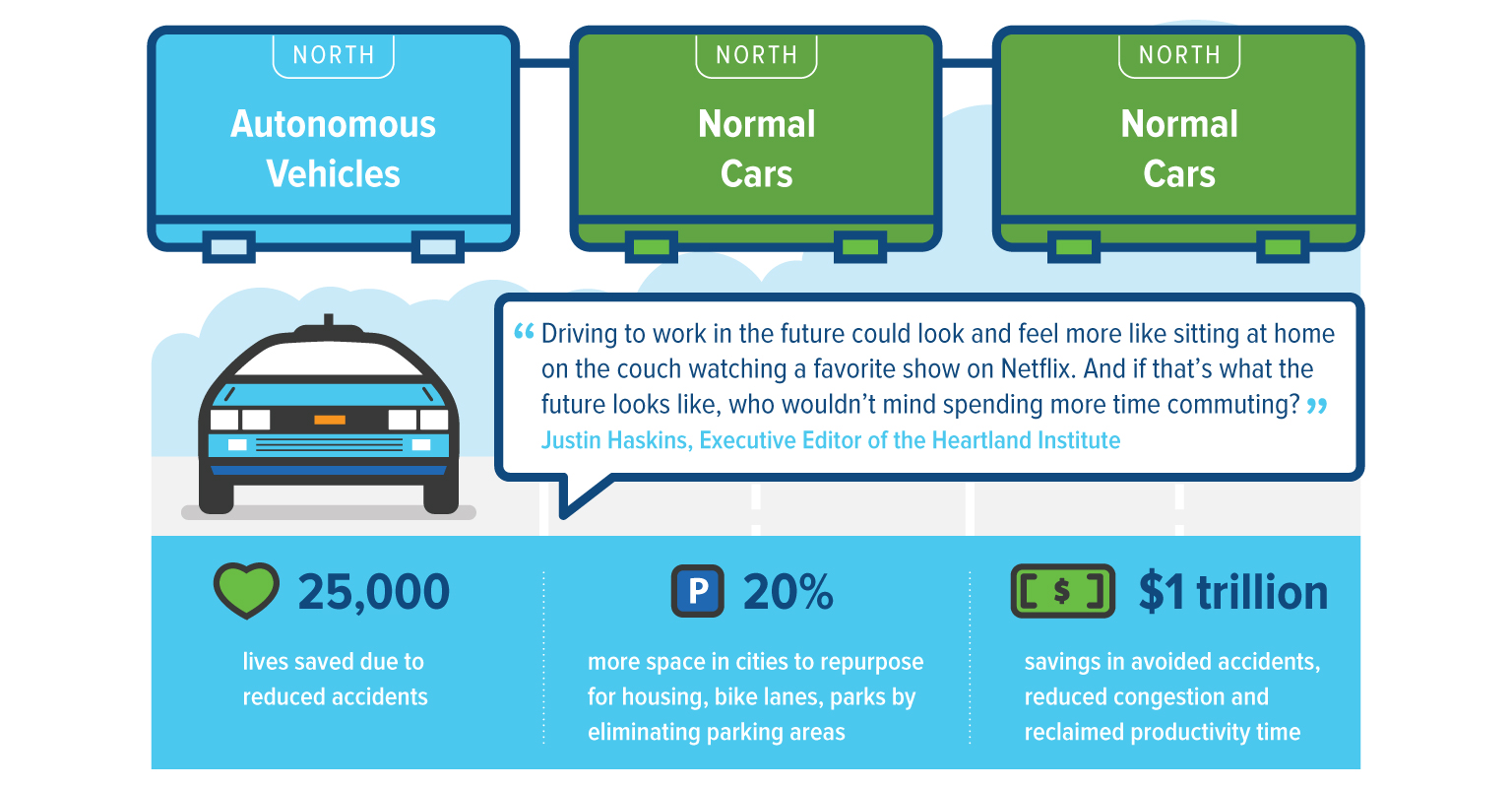

Clearly, many large companies are investing heavily in autonomous driving technology because they see that autonomous cars not only have the ability to drastically change the auto industry but also see the enormous cultural change that the presence of AVs could create. If we spend more time in the car and have more time there to do stuff . . they want to to be there.

As investors we have been most interested in watching how different stakeholders are shaping their strategies for competing in this market. For example, will automakers build their own autonomous technology, rely on partners, or both? Do automakers think they will continue selling autonomous vehicles to consumers or only to ride-sharing services? Will ride-sharing services companies want to move into other areas of the industry including building autonomous technologies?

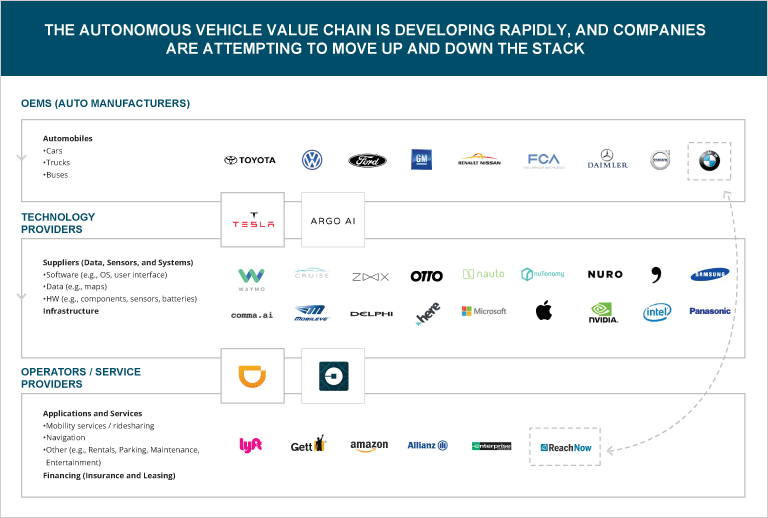

The Ever Changing Autonomous Vehicle Value Chain

Here is our view of the current state of the autonomous vehicle value chain. The three high-level layers of the autonomous vehicle market are

- Service providers (e.g., ride-hailing, ride-sharing, rentals),

- Technology providers (both hardware and software), and

- Automobile manufacturing

We see a significant number of companies sitting in between layers – such as Tesla building an autonomous driving system as well as being a car manufacturer – and we also see companies that have historically operated in one area making large investments of capital or time in other layers in order to move into other areas of the value chain. An example of this is

ReachNow, BMW’s rental and ride hailing service which is, among other things, a hedge against being cut out of a possible future where ride hailing vs car owning is the norm. Each of these companies sees an opportunity to capture a larger portion of the end-state autonomous vehicle value chain for themselves, and they are positioning themselves accordingly.

The AV Partnership Matrix – De-risking the future by teaming up

In addition to investing or acquiring companies or talent, companies have also begun forming partnerships to ensure they do not get cut out of valuable portions of the autonomous vehicle market or caught with single source suppliers for key technologies.

For example, with the rise of autonomous vehicles, companies realized that detailed maps might (though it is still under debate) be one of the most critical inputs to self-driving cars for determining whether the car is seeing the environment or another vehicle, person, or object in its environment. This led to several big moves in developing in-house maps and/or acquiring access to other sets of mapping data. For example, in August of 2015, a consortium of automakers bought Here maps for $3 billion; in July of 2016, Uber announced a $500 million plan to map the world’s roads; and in December of 2016, Mobileye announced a partnership with Here’s owners to share their mapping data.

Some other interesting takeaways we see from looking across the autonomous vehicle landscape are:

- The companies working with the major technology providers are also developing their own homegrown systems. For example, while Volvo is providing Uber with vehicles for their well-publicized Pittsburgh, San Francisco, and Arizona tests, they are developing their own autonomous systems as well through their Drive Me research project.

- There have already been some high-profile ‘breakups’ in the autonomous vehicle space. After Tesla’s crash, Tesla and Mobileye have pointed several fingers on who fired who (and whose technology led to a fatal crash), Baidu and BMW called off their joint work citing different development paces and ideas about research; but over time we will likely see more differences in tech and/or business philosophies that will lead companies to go their separate ways.

- Most of the major automakers have aligned themselves with a ride-hailing service – either via investment in the case of Toyota-Uber or GM-Lyft or in other cases building it in house or making a full acquisition. These moves have been interesting because the strength of Uber or Lyft’s driver network becomes less relevant in an autonomous, ride-hailing future. When you can put cars on the road without a person at the wheel, different elements become more important levers of success – namely the ability to manufacture, finance, and maintain cars. This could give automakers a head start later in the game, so to speak. Though success in ride hailing is also dependent on consumer penetration so companies like Uber and Lyft might have their own leverage over the automaker latecomers.

Other Stakeholders – What are the regulators, drivers, and consumers doing?

As we continue watching the moves that software companies and automotive companies are making in the autonomous vehicle space, we have also been keeping track of what regulators, drivers, and consumers are thinking and saying about autonomous vehicles.

To date, we have been impressed with how proactive the federal, state, and local governments have been in their support of autonomous driving technology. It appears regulators and planners at multiple levels are bought into the potential promise of fewer accidents, less congestion, more productive time for citizens and freed up space now devoted to parking lots in cities. But they are treading carefully, encouraging companies to experiment in safe, controlled ways. When the US NHTSA investigated the fatal crash involving Tesla’s Autopilot – the findings were actually that, though it failed in that instance, Autopilot had decreased the amount of crashes by 40% since introduction of the technology.

However, as this technology becomes mainstream and moves from high-end cars to widespread adoption among ride-hailing and trucking companies, there could be massive disruption to the way the workforce is structured in many different places around the country. A 2015 NPR review of Census data shows that Truck Driver is the most common job in nearly every US state. Autonomous trucks will have a massive impact on the trucking industry.

As more startups and large companies begin public demonstrations and public releases of their products, they must find the right ways to introduce these technologies for both public safety and public perception. “Drive fast and break things” will not be the right approach to releasing autonomous vehicles, and companies need to be thoughtful about the best way to introduce these technologies.

As investors (and eager consumers and citizens) we are watching how the AV market is evolving and looking for opportunities. If the innovations in the last five years happened twice as fast as expected, imagine where we could be in another five – or maybe just two and a half!