As recent entrants into the Venture Capital world, we continue to be positively surprised by the vibrancy of the start-up activity, the quality of tech talent and the richness of the innovation ecosystem in Seattle. Neither of us are new to the technology scene. Soma has been with Microsoft for a couple of decades since its early years, and Linda was previously at a security start-up in San Francisco. However, VC is a different game and we didn’t know quite what to expect from the Rainy City. It was not long before we discerned that unlike the Bay Area, the Seattle start-up community is tight knit and perhaps quieter, but no less innovative.

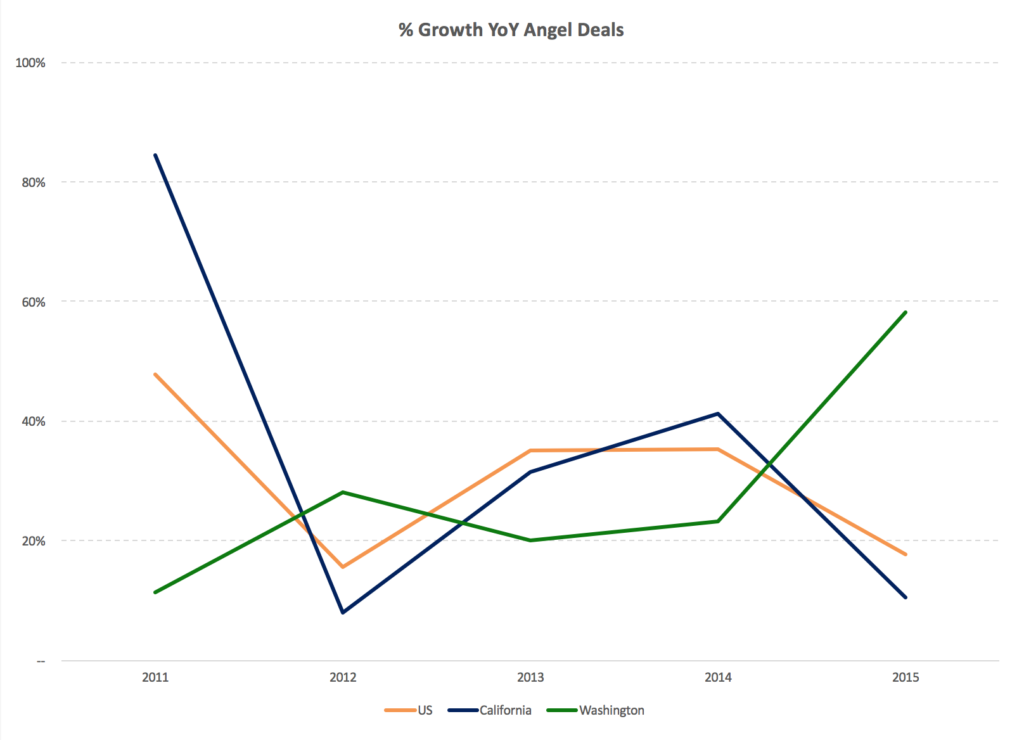

Much has been made in the past regarding Seattle’s lack of available early stage angel investments especially relative to the size of the ecosystem and the depth of the city’s talent pool. However, recent data suggests this is changing.

Seattle angel deals grew a whopping 80% (in 2015)

Linda Lian

According to Pitchbook, angel-backed deals grew only 10.6% in California in 2015, compared to a 58.1% increase in the Pacific Northwest. Within the core tech verticals of information and B2B, Seattle angel deals grew a whopping 80%.

Data: Pitchbook

This clearly indicates that angel funding growth in the Pacific Northwest is not only accelerating, but bucking national growth trends.

The city’s resistance against boom-and-bust investment cycles certainly lies in its strength within the fast-growing cloud space. However, there is a lot more in Seattle’s wheelhouse than just cloud. Seattle is also a burgeoning worldwide hub for VR technology and space exploration in addition to pioneers in ML/AI, chatbots, and natural user interfaces.

. . . if Seattle is to fully capitalize on its talent and resources, more of the area’s successful technology execs and veterans must leave the sidelines and get in the game

S. Somasegar

While Seattle’s growth has been remarkable and talent is in no shortage, there is still much to be done before the city’s full potential can be realized. According to a recent BCG report, there are 1.4x the number of angel investors relative to ultra high net worth individuals in the Bay Area. In Seattle, that same ratio is half. The extremity of the comparison must be taken with a grain of salt, as San Francisco’s core cultural identity cannot be separated from the reputation of the city’s startup ecosystem. The age distribution of SF’s wealthy is also likely to skew younger than Seattle. However, this does indicate that if Seattle is to fully capitalize on its talent and resources, more of the area’s successful technology execs and veterans must leave the sidelines and get in the game.

As an angel investor himself prior to joining Madrona, Soma believes angel investing is one of the best ways for a technologist to give back to the innovation ecosystem. This comes not only in the form of capital, but perhaps more importantly in mentorship, guidance and valuable relationships.

For angels that are already actively investing, they can also make a more substantial impact by getting involved with great entrepreneurs or products earlier in the funding cycle and not wait for somebody else to “bell the cat”. While Seattle’s strengths in B2B and enterprise software are indisputable, the willingness for the community to step out of its comfort zone to help nurture and develop consumer-facing companies that sometimes have the characteristic of viral growth before monetization kicks in could be the key to Seattle’s next big win.

It is amazing to see the wonderful, vibrant start-up activity that is getting bigger and broader every day. Seattle and the Pacific Northwest have an amazing amount of potential to be a phenomenal technology and innovation hub and we are excited to be a part of that journey.