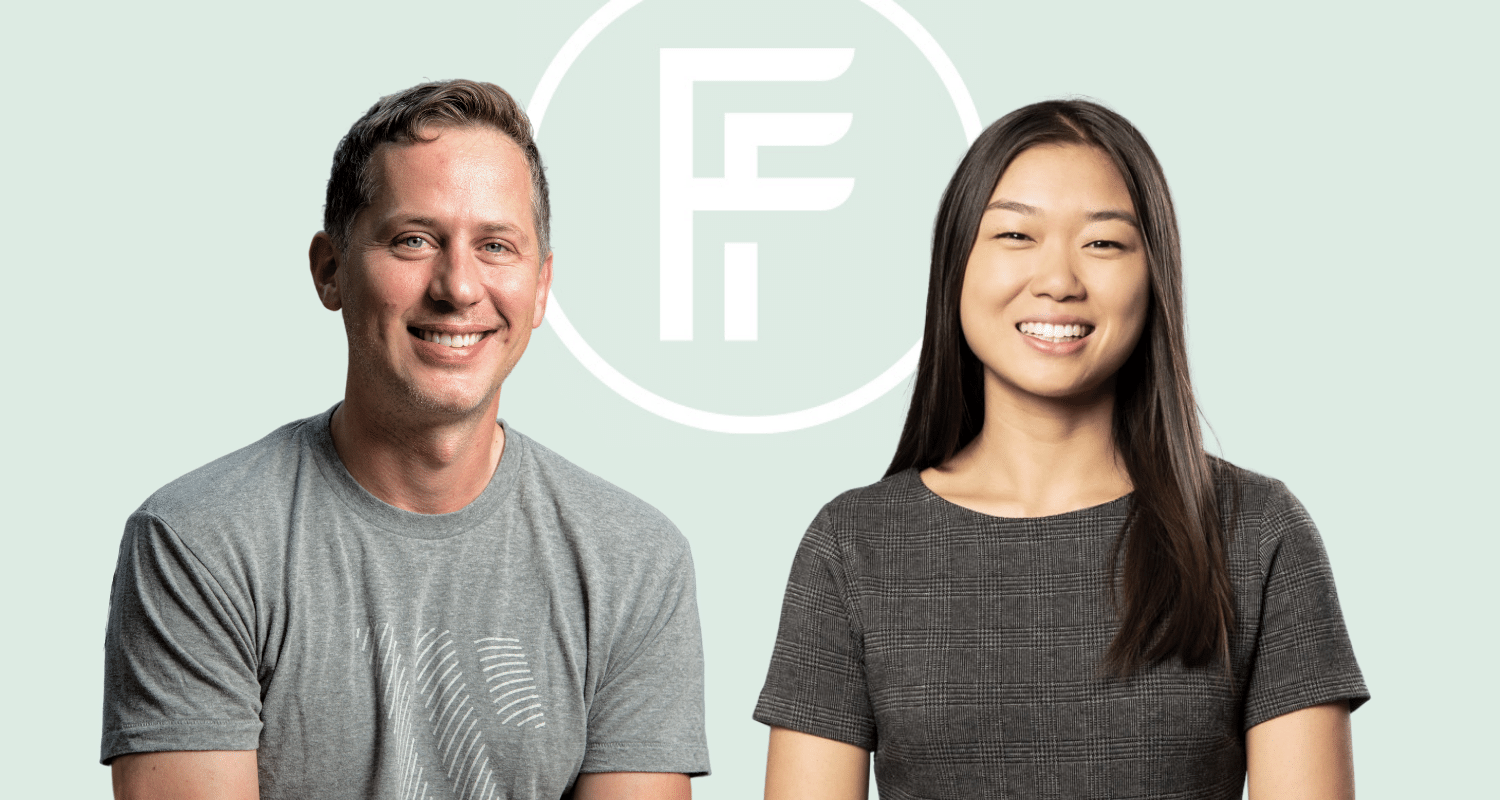

In this episode of Founded & Funded, partner Aseem Datar talks with Leaf Logistics Co-founder and CEO Anshu Prasad. Leaf is applying AI to the complexities of the freight and transportation industry, connecting shippers, carriers, and partners to better plan, coordinate, and schedule transportation logistics. This enables network efficiencies and unlocks a forward view of tomorrow’s transportation market while simultaneously reducing carbon emissions.

Leaf Logistics was founded in 2017, and Madrona joined Leaf’s $37 million series B in early 2022. From the beginning, Leaf has been fighting the one-load-at-a-time way that trucking has historically been conducted. The company analyzes shipping patterns to make sure that when a truck is unloaded at its destination, another load is located to return to the city of origin. Identifying these patterns allows Leaf to coordinate shipments across shippers at 1000x the efficiency and effectiveness typical in the industry.

Aseem and Anshu dive into the story behind Leaf, what makes logistics so complex, and how AI can continue to improve it. And Anshu offers up great advice for founders that he’s learned on his own journey.

So, I’ll go ahead and hand it over to Aeem to take it away.

This transcript was automatically generated and edited for clarity.

Aseem: Hi, everybody. My name is Aseem Datar, and I’m a partner at Madrona Ventures. And today, I’m really excited because I have here with me Anshu Prasad, who’s the CEO of Leaf Logistics and also the founder. Anshu, welcome, and glad that you’re spending time with us today.

Anshu: Thank you, Aseem. This is great to chat with you.

Aseem: So, you know, Anshu as they it all starts with the customer. Tell us a little bit about your journey and the problem space and what you observed talking to customers in this space, and how you narrow down the problem that you’re solving.

Anshu: I’ve had the benefit of working in the space for some time before starting Leaf. And in that journey, what I got to observe was what, when I started in the space, seemed like a winnable game slowly and undeniably became an unwinnable game. It was hurting both the buyers of transportation and the providers of transportation. And being able to sustainably do something for their business to make sure that they had healthy returns and they had some reliability on a day-to-day basis. It’s a big part of our economy, as we all appreciate, and if anything, the pandemic shown a nice bright light on the essential nature of a well-functioning supply chain — and what happens when it doesn’t function all that well. But in the in-between times, in between crises, transportation and logistics is something that we’d all just, frankly, wish we could ignore because it would just work in the background. But if it doesn’t work for the participants, the customers who are invested in the supply chain, it doesn’t really work.

And over the last couple of decades, it’s become clear that even big sophisticated companies for whom transportation is a big deal are finding it to be less reliable and less planable than they’d like it to be. So, that was really the core problem, seeing some very smart, very hardworking people that I had a chance to work alongside and serve struggling with a critical part of their business. And it became clear that it was a time for us, and many of the folks working at Leaf Logistics now who’ve also spent similar amounts of time poking at this problem, to do something differently rather than just wade into the same fight and try to do more of the same and hope for a different outcome.

Aseem: Anshu, maybe just double-click into this a little bit and give us a sense of the kind of problems both the shippers and the carriers face on a day-to-day basis.

Anshu: At the fundamental level, this is a very transactional industry. A truckload from point A to B is seen as a snowflake. And for anyone outside the industry, it seems really alarming that it would be that way. Because we have all had the experience of driving down the highway and seeing every color of truck you can imagine on the road — how is this being done one load at a time? But that’s really, for a host of reasons, the way that this industry has evolved. So, the core problem as it gets felt by shippers is transportation becomes a one-load-at-a-time execution challenge. And if you’re a big shipper, you might have 500,000 or 600,000 loads a year that you need moved, and you’re treating each of them as an individual OpEX transaction.

And on the flip side, the carriers are responding to a demand signal that is very fleeting. It is, again, just one load at a time. I’m getting a request 48 hours in advance to go pick up a load in LA and then drop it off the next day in Phoenix. But I don’t know anything else beyond that. I don’t know what I’m supposed to do once I unload in Phoenix. Where is that next load going to come from? And I’m supposed to get up and start to play this game again, one load at a time, tomorrow. So, the ability to keep my truck utilized or my driver paid, maybe even return the driver back home, which is very important for the driver, becomes really hard for me to manage. So it becomes a constant challenge of trying to catch up with the transactional intensity but not really solving the traveling salesman problem. We think that should be solvable, but it’s not really what the data on the table allow us to do.

Aseem: Yeah, I mean, it’s, it’s just fascinating to understand and learn and, you know, as we’ve sort of worked together, just get educated every day on the complexity of this industry. I have been curious about this for quite some time — how did your background, your consulting mindset, set you up for tackling this huge problem and for ultimately achieving success in this industry?

Anshu: When I entered the startup world in the late ’90s, the flavor of the month was to apply technology to old problems. And we lucked upon an area where freight buying is a big deal for many companies in CPG, for example. We helped them buy their freight using basic technology that allowed them to automate a process that they’d been running for decades, using floppy disks and in web 1.0 kind of ways. And that helped to streamline some of the basic procurement processes. But it gave us an appreciation for the centricity of this purchasing decision to their core business operations. At the end of the day, everyone obsesses over their customer, and transportation is often the last point of interface with your customer, and yet we’re buying it as if it was just this free for all transactional auction. And so, what was getting lost was that sort of customer engagement, the customer entanglement from a well-serviced, well-structured supply chain to something that is very much ephemeral.

And the way that I kind of landed up in the space was a little bit by circumstance and by happenstance. We ended up helping companies like a Unilever or Bristol Myers negotiate their transportation rates. But what really drew me in was working with the people who had to do this work on a day-in and day-out basis and just empathize with them for a moment. You come to your desk at a Coca-Cola every day, and you’ve got a stack of shipments that need to get covered off, and you work your way through that stack as much as you can, and you get home and come back again tomorrow, and again, you have exactly the same Groundhogs Day problem. The only thing that shifts is outside of your control, ie. what is the market doing? I mean, if you’re a company like Coca-Cola, you’ve hedged your exposure to things like aluminum prices or sugar or high fructose corn syrup, and yet the second or third largest cost in your business, which is your transportation and logistics, is a bit of a guess and a gamble, and it shouldn’t be. And so as we, over and over again, and as I got into consulting, I saw this problem around the world, as we confront sort of the unreliability, not just of service, but of just the exposure that we have in our core businesses to this big cost item getting out of control. And last year was a good example. There were several top-fold of the Wall Street Journal shippers who all do a great job managing their transportation, just being subject to the whims of the market and being tens of millions of dollars over budget to the point where their earnings were depressed.

That is something that needs to get solved better with today’s data. And why I and many of the folks working at Leaf Logistics focused our energies on solving for something different was this is a remaining sort of big risk that looms in people’s business operations. And I’ve talked a lot about the shippers. If you think about the million or so trucking companies that are registered in the country operating at razor-thin margins, the roller coaster of the freight industry hurts them just as badly. And so the idea that no one is really winning and people are paying, and people in specific terms, layoffs, and bankruptcies are impacting this industry adversely. And it’s happening with increasing frequency over the last several years. Something should be done differently. As opposed to more of the same.

Aseem: I think the meta takeaway for me is that you have an asymmetric advantage, having spent so much time in this industry and really understanding the business processes like you described. And it’s amazing to me that the biggest spend has kind of often gone ignored, and you guys are doing a killer job in trying to build, I would say smart systems and intelligent applications around it. You know, one question that comes to my mind, Anshu, is that you’ve been steeped in this industry for quite a bit. You’ve been on the consulting side, you’ve been on the advising side. And starting a business is no small task. Especially in an age-old industry like this, where things are often done the way they’re done. And that’s the same way has been going on for many years. What headwinds did you face in, you know, tackling this problem in this industry, like landing your first big customers, can you just tell us a little bit about that journey?

Anshu: So there were three areas that I really focused on. One was customers. If we built something fundamentally different, would they be willing to take a risk and try something different? And let’s face it, you know, trucks are moving around the country, and they have been, somehow, people are muscling it through. So would there be a case for change? One test was talking to 50 perspective customers and saying if we built something, would they be willing to test it? Second was what is that earned insight that we had for so many years poking at this problem? What are we seeing that other people are not seeing because they’re caught up in the day-to-day fray? And that was fundamentally that much of this problem is planable. And if you apply a different sort of analytical approach to this, you could understand and uncover the planable bits and, at minimum, take the planable bits off the table to allow people to focus their creative energies on the stuff that just needs to be triaged through brute force.

And then the third was that you had to put the pieces together. And for me personally, the third piece was the most important. Finding other people who had worked with, who had seen this problem from different perspectives and angles, who are all kind of seeing the possibility of solving the problem differently enough that they would drop their current work and come do this. And the personal conviction from individuals that I had a ton of respect for, and I knew that they brought special skills to the table, come and jump into the boat and start rowing, gave me the most momentum of anything.

And so getting that first customer was as much about having built something off of a particular understanding with a set of folks who had special skill sets as it was about convincing that customer. To be honest, I think some of the early customers said, I understand what you’re describing. I think you guys will figure it out. They were betting on us as much as anything, and it was as much a partnership around sniffing through the common problem that we saw and working and iterating on that to solve for a different outcome. We were as invested as the customers were. Those early customers saw as much in the promise of what we were trying to build as we did. They just didn’t have necessarily the same sleepless nights as we did.

Aseem: I had the privilege of talking to a few of your customers, and I could say that they were not just fans, but they were raving fans. And I remember one comment where one of them said to us that I think Anshu understands and the team understands the problem more than we do. Which is a testament to your empathy and your, you putting yourself out in your customer’s shoes. Anshu, was there a moment when you started talking to these 50 and going deeper into the problem where you thought that I’m onto something, right? Was there a turning moment, or did it just happen at a consistent pace that built your conviction?

Anshu: I think what started to build conviction the most was how quickly we could arrive at a common understanding of the problem. It became very crisp and clear. So, if we just basically said, you know, and this past year is a good example. This past year can never be allowed to happen again, says the budget holder at a big shipper. That acknowledgment that something is fundamentally broken. It may be incredibly complex to solve, but just the common understanding that there’s a problem here versus the things are happening. Things are getting done. There isn’t a compelling case for change — that would’ve been a warning sign.

So, there were a couple of ideas that I’d been chatting to folks about, and they all agreed that there was some value to be delivered, but it wasn’t clear that it was a problem compelling enough to go take a risk. And in this particular case, the risk was give us data that you’ve never given to anybody else. A brand-new startup that’s starting out building the technology. Give us data you’ve never given to anybody else and trust us to be good stewards of those data is a big ask. And I was surprised and really encouraged by how many people were willing to part with these data in such a transparent way. Because, you know, it signaled to me that they appreciated the importance of a potential solution. They didn’t know what the potential solution was quite yet, but they were invested in trying to work toward one.

Aseem: Great point. I think often, people look at their data and say, hey, this is data that I’ve collected. It’s sort of my crown jewel. And it’s a huge testament to you and the team where, you know, customers came to you and said, look, I’ve got all this historics, but in some senses, I don’t know what to do with it. And if we can find a meaningful way to mine that data, not just look at it as mere flat files, but derive insights and then take action and complete the loop, like that’s the holy grail, which I think Leaf Logistics is doing so beautifully.

How are you thinking about building intelligence into your solutions? Tell us a little bit about your vision around the smart applications, the ML/AI-infused things. How are you thinking about next-generation technology as an enabler to solve this unique problem?

Anshu: Yeah, it’s actually an interesting area to apply that branch of analytical thinking and algorithmic decision-making. So we apply machine learning to large longitudinal data sets as sort of a starting point for the work that we do. So we understand that there are some patterns that will hold, and we can plan and schedule freight against those patterns. Just doing that, using some of the technology we’ve built, allows us to coordinate those shipments across shippers at a thousand times the efficiency and effectiveness that people in the industry do. So that confers a pretty significant advantage. Just planning and scheduling with the benefit of machine learning, pointing us to where we know that patterns will hold.

Where we’re starting to see some decision-making get enhanced is there are way too many inputs, right? So just with two or three shippers, the numbers of decision variables you might need to consider, too, for example, we’re working a fleet right now that works across multiple shippers in eastern Pennsylvania. It keeps 10 trucks and drivers and 32 trailers busy on a continuous basis. But on load by load level, that could mean there’s a load that is being fit into a, a standard plan that the pattern identified by machine learning holds over and over again. But it could also mean that there’s a load that needs to be taken to Long Island or to Ohio, and you need to be able to solve for that. And the consequences of stretching the fleet to Ohio needs to be factored in. And that sort of supervised learning based on those different inputs so that the algorithm is smarter the next time that an Ohio load pops up on the board becomes important. And building the technology to think about that because we know that those problems exist, I, we see that in the historical data. And so, how can we train the algorithms to do that? To kind of give you an example- optimizing for those decisions on a weekly basis as opposed to annual basis, which is what the industry typically does, confers anywhere between six and 16% advantage. So just literally taking sort of the learnings from week one and applying it to week two. Week two, applying it to week three, can have that kind of an impact. You know, let’s call it 10% on a $500 million spend — that is an enormous impact for a company.

What we don’t know is what shape it will take in the future sort of working of this industry. There are something like 5 million white-collar workers in U.S. logistics. Do we arm them with better decision-making tools so that the transactional work that they do now they have better data at their fingertips so they can execute smarter decisions? Or do we do what media buying and ad buying have done, where the algorithms take some of the rote decision-making and figure that out and execute that so that the creative brain power of the humans can be focused on up and downstream decisions that are impacted by transportation? I don’t know which way the industry will evolve and at what pace, but there are significant opportunities for bringing some of these technologies into this industry.

Suffice it to say that the millions of man-hours that are spent doing transactional work. I think, for most people outside the industry, it’d be alarming the level of manual intensity that transportation still requires. It will be rung out of the system. Exactly how that will be rung out of the system so that people can work on, hey, if I now know the rate from Dallas to these two locations three months in advance, how would I structure my production scheduling and my manufacturing processes differently? You just can’t answer that question today because those data don’t exist. But when those data exist, there are some very interesting problems for humans to spend their energies on versus what the machine or the algorithm can take off their plate.

Aseem: That’s fascinating. And you know, I, I, I think this is really unique as to how you guys are thinking about the problem and bringing the technology of today to solving a very well-known complex problem.

Anshu: It is fundamentally something we’ve all bashed our heads against the wall at for a long enough time. We talk a lot about waste in the industry and in terms of empty miles and emissions associated with them, but there’s just the waste of human capital. Today, a truck driver in our industry, if he or she’s driving empty to pick up the next load, they don’t get paid. They’re paying for diesel out of their pocket in a lot of cases. And then there are, of course, the man-hours wasted. On average, over four hours are wasted at pickup and at delivery, loading, and unloading. And so many inefficiencies that we’re all paying the tax for. If we can free up the human capital to work on more interesting, more valuable problems, we’re all going to be better off.

Aseem: You know, wanted to sort of just pop back up for a bit to get back to the 30,000 feet view. How are you thinking about scaling, and what are the challenges in front of you?

Anshu: It’s a very interesting problem, and in some weird ways, because of the complexity of the problem, there are multiple areas to pursue. So, one of the main things for scaling is to continue to have a disciplined focus on the few things that we think will make the most difference to our customers over the next handful of stages of our growth.

That focus and discipline becomes a really important thing for the management team to focus on, which brings me to maybe the most important point. One of the things that we’ve been very clear-eyed about is the team that it took to muscle through and get from zero to one may not be, and likely isn’t, the team that scales from where we are to where we’re trying to go. There just different skillsets. The obsession with the problem. The ability to iterate and think in first principles was essential for us to get off the starting block. Now we have to take the pieces of product-market fit and repeatability and drive toward scalability by looking at patterns and executing against those patterns with discipline. And hiring and upgrading our talent and challenging each other to make sure that we’re not settling for the status quo have been really important. Culturally we have a very transparent and open culture. Many of us have had the opportunity to work with other people on the team in past lives. So, there’s built-up trust, and yet we’re all trying to do things that scaling is an interesting word to use in the context of a startup, but human beings don’t scale very well. There are certain things that we do remarkably well, this is an organizational culture challenge to build something that scales, and that might mean that myself and others need to give up things that we used to get our hands dirty with to allow other people to pick them up and do a better job with. And that is, frankly, a big challenge. Hiring for and building the organizational muscle to genuinely scale as opposed to just doing a few of the things that we’ve been successful at a few more times. It’s really, it’s fascinating. And what’s been interesting is the learning that we, almost on an individual level, you can palpably feel are going through. This idea of letting something go that you used to obsess all night over because somebody else can come pick that up and, within a couple of hours, have a different solution than you, just because they look at the problem and frankly at the world differently than you, is a learning experience, a growth opportunity for many of us.

Aseem: Well said. So much of it is, building the right team, hiring folks that are coming from different backgrounds, different points of view, looking at the problem differently, but also world-class at what they do, right? And oftentimes, that’s probably not the existing team that’s there because they have different domain expertise or they come from various stages of a company’s life cycle as you scale fast. Another question on that front is, how do you think about repeatability and understanding patterns on what to invest behind? The challenge with scale is often prioritization because you can’t scale if you are focused on too many things. I mean, Yeah, you can scale horizontally, but that often doesn’t make you best-in-class in certain areas. So, what’s your guidance to founders or companies who are just slightly behind you on prioritization and being maniacally focused on a few core areas?

Anshu: I think that’s one of the toughest things for us to do and, honestly, to challenge ourselves to ensure that we’re applying the same strict filter continuously. Because sometimes we fall in love with our own ideas. And one of the challenges for an experienced team like ours is we do have so much familiarity with the problem, but we might be a little too close to it. So sometimes, our hypotheses are are tough to let go of. And similarly, even our most high-conviction customers might not be able to tell you what is it that they want next. So this is, oftentimes, when we’re talking about something different, we’re skipping a few logical steps in the solution design. So asking the customer for a set of features might lead us down the wrong path. And being able to really understand that requires that we have more than a handful of data points. And so we have this sort of ethos here that zero to one is very hard. One to 10 gives you data. And one to 10 is just, we’re going to be disciplined in making sure that we get enough data points so that we are not getting skewed perspectives that we double down on, and we don’t scale until we’ve got that repeatability understood. So repeatability and scalability are seen as distinct. And oftentimes, the people who are invested in innovation are not the people to take it to repeatability. And the people who are in the repeatability motion of sort of new ideas that we germinate with our customers are not the people that are responsible for or charged with scaling it.

And that sort of baton handoff has been helpful because I think that’s something we struggled with. Just switching gears as the founding team was very hard to do because, to your point, each idea deserves a ton of scrutiny and attention.

The other sort of lens that we apply is we have north star metrics that we look at, and we look at the differential impact of those north star metrics from each idea. So, it’s almost like a mini PNL ROI-based argument per idea. An exercise that we go through, which is different from the standing sort of reviews of the project planning and the metrics, it’s stepping back and saying, if I had to draw the line at three, which ones would be above and below the line, and forcing a debate. So, people are then debating the data that they have, the ideas, as opposed to any sort of custodianship for, you know, the work that they’ve been doing. It’s learning from great companies who will put competing teams to work on the same feature because they learn so much from looking at the same problem but with different diverse teams tackling the problem independently. We’re trying to just borrow from those pages. And that means that reprioritization is as important as prioritization in the face of new data. But it just becomes the way we work, and we’re trying to develop that muscle as we scale because we start to get to be a larger company, to be able to reset priorities doesn’t seem like what big companies do very well.

Aseem: The one thing that I’ve observed in partnering with the team, which is just amazing, is you all think in terms of 10x, you all think in terms of the outsized impact that an effort or a project or an idea could have relative to the metrics. Does it improve it by 5%, 10%, and is it worth doing it, or does it actually have its own leapfrog moment where it’s having an outsized impact if you go funded or if you go execute on that idea? That’s a good sort of framework for somebody to have as they think about scale.

Anshu, let’s talk a little bit about your experience and your principles around hiring and adding to the team. What tenants do you keep in mind when you hire people, especially at this stage in attacking this scale challenge? What roles are you adding, what should founders in your position know and learn from you on how you are thinking about the right kind of team and shaping the right kind of, I would say family, to go after this problem?

Anshu: Yeah, I think family is a great term for it. I think one fundamental thing is that the needs shift. Early on, one of the most important things we look for are people who have demonstrated grit. That they’ve had to go out and find a way through. And that can come in multiple disciplines, but there’s something to be said for finding a way through. And the shift between that and the scaling phase now is the thing that we spend a lot of time doing, even in panel interviews and group discussions with some final round sort of leadership candidates are filtering for the ability to distinguish between the things to pursue and which things to leave behind. And that honestly is very hard for that founding grit-based team. Cause that grit-based grinding team, they can’t leave any stone unturned. You just keep working. And the problem with scaling is you can’t afford to have every detail consume your time because it gets you in the way. So, the ability to put the blinders on and make sure that the blinders get tighter with each iteration is a skill that people who’ve scaled before seem to demonstrate, and they can prove that to you. We can even look at our current set of priorities that people who are working at Leaf Logistics right now are struggling with force ranking or prioritizing. Put that in front of someone who’s had scaling experience, and they’ll ask the right essential questions to be able to distinguish and at least relatively prioritize those items on the list. That’s the clear-eyed kind of perspective that I think at the scaling stage is distinct from that sort of grind it out and find a way type person or people you’re looking for at that early stage.

Aseem: just following through on that thought. Leading into 2023, Anshu, I know you’re growing, you’re adding to the team. Tell us a little bit about what would ‘great’ look like for you this year?

Anshu: There are three things, and we try to make sure that at this point, for everybody on the team, we all know what those three things are. The first is we are seeing the coordination thesis that we’ve started with actually playing out, and that’s driving an improvement in our net revenue picture. And so, as we get more scaled, frankly, people who haven’t spent as much time as you and your team have, Aseem, understanding what we’re doing and why can look at the business from the outside and understand the progress that’s being made in just pure sort of financial statement terms. That’s an area of focus. So we’re just trying to get those clear financial metrics to jump from our performance. And that is, through doing some things that are pretty cool and pretty distinct in terms of being able to build circuits and continuous moves and even deploy fleets and parts of the geography that others aren’t able to do. And we, frankly, put a lot of effort in being able to get to this point but to go execute those things and show that impact on the bottom line is job one.

Second, is the only way or the best way that we think that we’re going to get there is to double down with some of our key customers who are growing very rapidly with us, but there’s still yet another gear that we can hit together. And so, account management becomes incredibly important as a discipline to not just further build out but to enhance. And the amazing thing is that there’s just as much appetite from our customers. We’re finding engagement at such different levels and across so many different personas that it’s an incredibly intellectually stimulating exercise to find those different perspectives because many of these customers, this matters a lot. So just earlier today, we had one of our logistics service providers, CEO and CFO, in the office, specifically talking about their 2023 plans and how much the work that we are doing together could impact that trajectory. And that’s the kind of partnership we’re really looking for from an account management perspective.

And then the third thing for us is to make sure that we are prioritizing the 10x moonshots that are coming next. You know, how do we build upon some of the early advantages that we’ve established to continue to do things that other people just don’t have the established foundation to do?

So, we’re really excited about some of the payment and lending-type solutions that we can bring to market right now in an economy where those types of solutions are pretty few and far between. This is still a massive industry with huge inefficiencies and a recognized need for change. A lot of innovation needs to be brought here to mitigate the significant amount of waste that we have in the industry. That hurts both people and all of us indirectly as the environmental impact of an inefficient supply chain is experienced across the economy and climate. How do we make those investments possible? That’s going to require innovation and the 10x ideas that we’ve been of working on. Making sure that those ideas see the light of day that they’ve germinated, but also that we talk about some of those things to pull some of the next set of customers and prospects into the journey with us. There’s a fair bit of growth for us this year, Aseem, but we will sacrifice top-line growth for growing with the right people at the right pace, with the right level of innovation to set us up for the future potential that we see for the company and for the impact that we can have on this industry.

Aseem: One of the things I admire about you and the team, Anshu, is just this notion of growing right versus growing in an inflated way. And I love the fact that you’re looking at 2023 from a, Hey, what’s today? What is one year out, and what is the 10-year out change in this industry look like? And aligning yourself with that. Anshu, it’s amazing to me how the team has come together and how you’re hiring, and how you’re growing. You know, you talked a lot about you’re so focused, and you’re so close to the problem, but who is your sounding board? Who do you go to for advice? Tell us a little bit about that.

Anshu: You know, as I said before, I think people don’t scale, and that goes for founders. I think a lot about people who can work on the business as opposed to in the business. And that’s where our literal board folks at Madrona, but also just generally people from outside of Leaf Logistics, can look in and see what they see. So, I make it a point to start my week with external advisers and to bookend the back half of the week with the same because, at the end of the day, I’m not building this company for anybody aside from the problem. And the problem needs to be solved furiously, sort working on the problem from the inside is insufficient. It needs to translate. And so that external perspective is really important. I think, for me personally, making sure that the blinders aren’t on too tight in terms of the narrowness of scope. I probably read more widely than I did at the earlier parts of the company’s growth. And I’m always on the lookout for things that will just be absorbing and bring different perspectives. Understanding what’s going on in other fields, being able to speak with people who’ve just done outlandish things in other disciplines, and understanding what types of models of leadership there are. Entrepreneurs who are further along on the journey are incredibly helpful to learn from because they have run through some of the roadblocks, and they’re incredibly generous with their advice. So I think those are the three areas. Really making sure that the personal growth at least tries to keep pace because it’s not realistic that any of us evolve that rapidly. But it’s a lot of fun. And it’s a lot more interesting and multifaceted than it might feel on a day-to-day basis.

Aseem: Anshu, any parting thoughts for founders who are new or first-time founders or thinking about walking in your shoes and are just maybe a year or 18 months behind?

Anshu: I, I asked that question of founders 18 months ahead of me, and I benefited a lot. So, hopefully, this is of use to some of you. Really two things. One is to ask for advice and ask for people to pressure test your problem. And funding and fundraising will come with that. Asking for advice will bring you money. Asking for money will bring you advice, as somebody told me early on in my journey. And that was really helpful. And every single partner that we have today, we engaged in a conversation outside of, and well before, there was a fundraising opportunity. So, it was really about understanding do we see the problem the same way or do we see pieces of the problem that we could be helpful to each other before it was time for fundraising.

The second is, clearly, there are a lot of exciting things about the fundraising process itself, but if anything else, it’s a learning opportunity. You’re not just pitching your company, you’re getting an understanding of who else is out there, what perspectives they have, and what can you learn from. If you really love the problem you’re trying to solve, it’s not about winning the argument or getting your point of view across. As fun as it is to watch Shark Tank, it is not about trying to convince people to just follow along with your way of thinking. It’s about making your thinking better, so you can solve the problem you came here to solve. And the best thing I think I can say about working with Madrona and other key investors and partners, and advisers that we have around the table is they love the problem just as much as we do.

I will get pings, texts, and phone calls with ideas around why does this or why not this as much from people that are not working the problem day to day as those who are, which gives me a lot of confidence that I think we have the right team assembling to really solve something that matters over time.

Aseem: You know, I will say that having known the team for quite a bit now, I have had a deep level of appreciation for this industry and the challenges that your customers face on a daily level. And I often find myself wondering, where is this person driving the truck going from point A to point B? Where are they going? Like, how much load are they carrying? And it’s fascinating. If you’re in that job, you’re powering the economy, and yet you have a suboptimal experience as a person who’s doing a very tough job, and I think I, I feel nothing but empathy on that front, but Anshu, thank you so much for taking the time. And we couldn’t be more thankful to have you on this podcast and for sharing your words of wisdom. Good luck in 2023, and we are excited to be on this journey.

Anshu: Thank you, Aseem. Thanks for the continued partnership. It’s going to be an exciting year, but there is much more to do.

Coral: Thank you for joining us for this episode of Founded & Funded. If you’d like to learn more about Leaf Logistics, please visit their website at leaflogistics.com. Thanks again for tuning in, and we’ll be back in a couple of weeks with our next episode of Founded & Funded with Common Room Co-founder and CTO Viraj Mody.

This week, Investor

This week, Investor