The Pacific Northwest is a major hub of tech innovation. It is also a hub for life sciences research, biotech and healthcare innovation. The past several years have brought increasing convergence of these disciplines, most notably the nexus of life science, computer science and data science. This combination has been a driver of new breakthroughs — i.e. use of machine learning in discovery, diagnostics and therapeutics.

Our region is home to two of the top market cap companies, Amazon and Microsoft, who are both leaders in cloud technologies. These companies are defining and building the scale infrastructure and platforms, including major advancements in Machine Learning (ML) and Artificial Intelligence (AI), for next generation applications. Major research institutions such as the Fred Hutchinson Cancer Research Center, Allen Institute for AI (Ai2), Allen Institute for Brain Science and a growing ecosystem of companies (e.g., Adaptive) are starting to leverage the power of data, algorithms and computing power to develop breakthrough research and products driving critical improvements in healthcare and global health.

The convergence is enabling new opportunities in the broader healthcare and life sciences markets – spanning from traditional healthcare IT to digital health to diagnostics to next generation therapeutics and automated scientific discovery. We have already invested in several companies in this area – Saykara which is bringing NLP and AI to the world of medical scribes, Accolade which helps employees get the most out of their healthcare plan using software intelligence and people, and Envisagenics, the recipient of the Madrona/Microsoft AI prize which is applying AI and high-performance computing to uncover novel cures in RNA sequencing data.

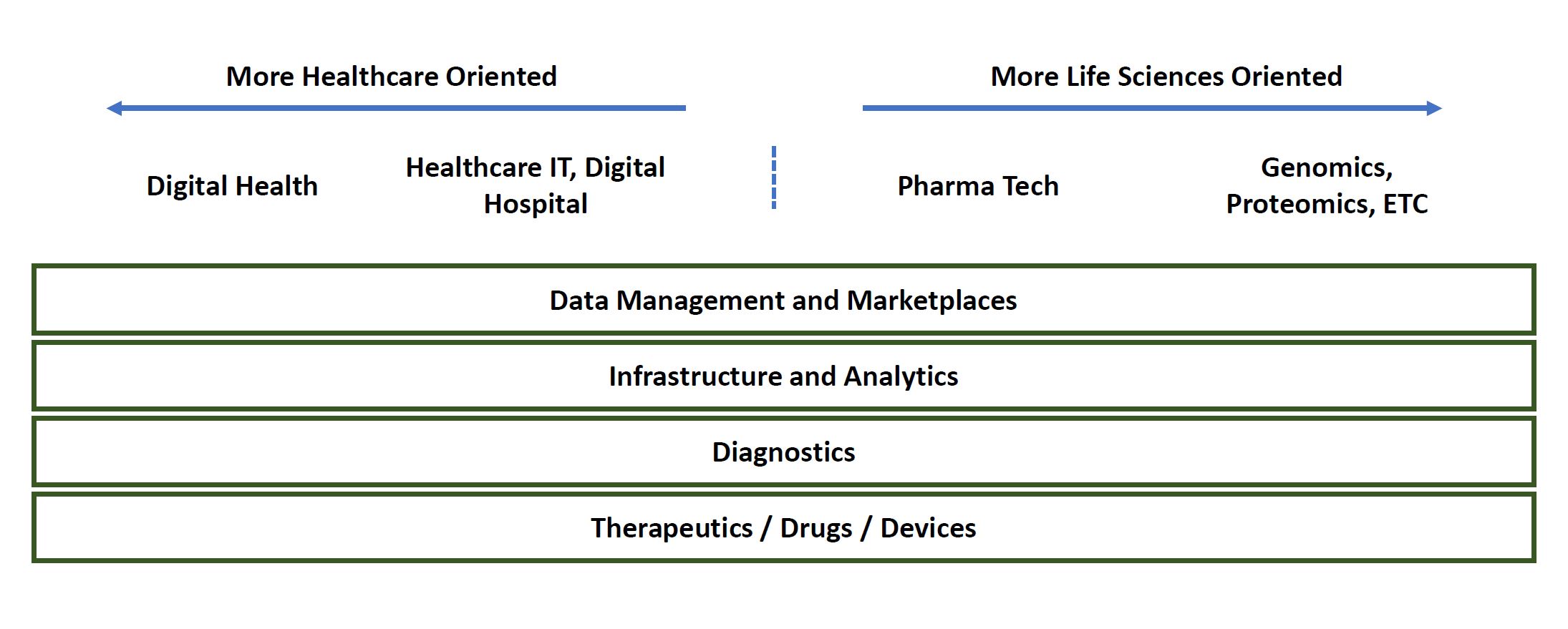

In working with entrepreneurs and the local industry, we’ve looked at the broad market, divided it into “more healthcare” and “more life sciences” and identified areas of specific interest where we see substantial opportunity for software and data-science/AI driven innovation and are within our expertise. Our map of this intersection is below and we will highlight a couple areas of particular interest.

Diagnostics: In the area of diagnostics, ML and AI techniques are already empowering next generation clinical decision support services into the market. The application of computer vision to radiology and pathology is one example. Companies such as Zebra, Viz.AI, Imagen, and others have had AI/ML based medical diagnostics achieve regulatory approval in areas such as stroke diagnosis, atrial fibrillation detection, fracture diagnosis, and others. In the area of cancer diagnosis, new companies such as PAIGE and PathAI are making major strides. In the past year, we’ve seen an increase in new AI-powered offerings achieving regulatory approval in a broad range of diagnostics from stroke to wrist fracture to heart & lung related diagnostics and others.

Infrastructure: To support research and development of new drugs fueled by an understanding of genomics data, there are several important infrastructure categories. One thing we’ve noted over the past year is that our software and infrastructure companies are seeing growth in this vertical. One of these is Qumulo, which provides next generation file storage for institutions like the Carnegie Institution for Science which works with terabyte-size data sets alongside millions of tiny sequencing files.

Analytics: On the more traditional IT end of things, we see an opportunity for analytics that overlay systems for running labs, processes, healthcare systems and more to provide better insights and help drive operational efficiency and improved care. KenSci is a good example of a company working on analytics for large hospital systems.

Data: And, underlying each of these categories is a significant need for data. Data is what will power diagnostic services development, drug discovery, clinical trial matching and many more clinical and research applications. There is a need and opportunity for data providers and ecosystems to leverage the data to drive the innovations we all foresee. Existing players such as Prognos, Patients Like Me, Tempus, and RDMD are all working on this space and we are excited to see the next wave of innovation in data acquisition and management.

As 2019 unfolds we will continue to share our thoughts and if these areas are of interest to you, please engage us.