AWS is another year older, bigger and more diverse and so will be the 6th Annual Re:Invent conference. Over 40,000 attendees are expected to attend the event reflecting the success of AWS and the cloud movement that the company kick-started. If AWS was a standalone company, it would be recognized as the software company that hit a $20 billion annual revenue run rate in the shortest amount of time. From a branding perspective, AWS appears focused on courting “builders” including business leaders, product managers and developers who want to create, or recreate in the cloud, solutions that solve real world problems. From a thematic perspective, I anticipate five broad areas to be highlighted:

- Modern services for modern cloud apps

- ML/AI everywhere!

- Hybrid workloads go mainstream

- Enterprise agility exceeds cost savings

- Customer focus balanced with competitive realities

Modern Services and ML/AI

The first two themes – Modern services and ML/AI are targeted at the grass roots builders and innovators who have long been associated with AWS. Modern services include containerized or “serverless” workloads that work individually or in conjunction with other microservices and event-driven functions like AWS Lambda functions. These technologies deliver greater flexibility, interoperability and cost effectiveness for many applications. And, they can be used to either build new applications or help modernize traditional applications. I have spoken to several smaller businesses and small teams at larger companies who are leveraging these capabilities to build more responsive and cost-effective applications.

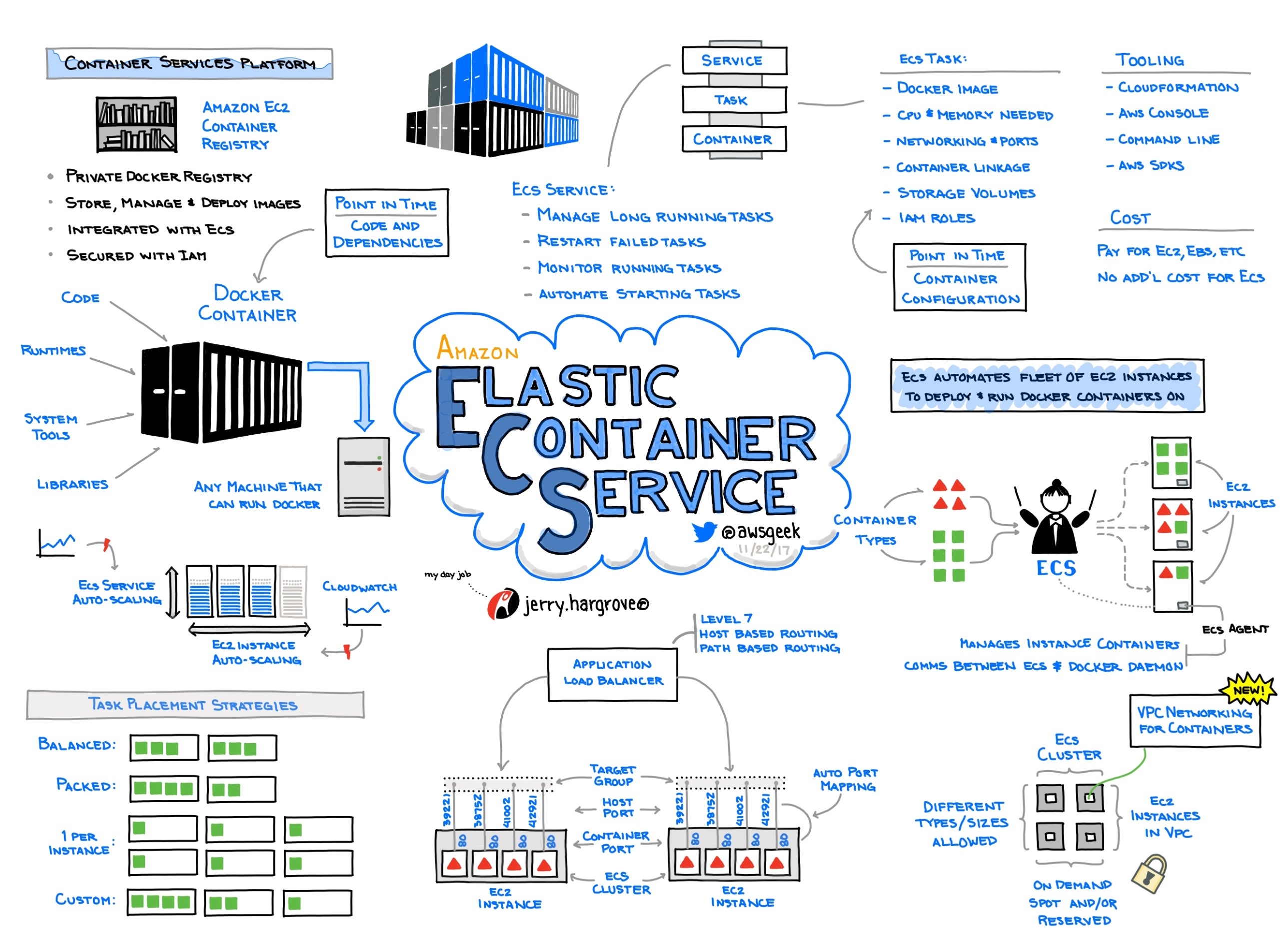

At Re:Invent we expect to see AWS embracing community standard like Kubernetes for orchestrating modern containers like Docker. Above is a visual highlighting AWS Elastic Container Service and the use of related services on AWS. AWS will also highlight innovative approaches in the cloud and at the edge that build on Lambda functions to ingest data and automatically produce a functional output. I wouldn’t be surprised to see a “developer pipeline” for building, testing and developing these types of event-driven applications.

ML/AI will likely be broadly highlighted in both Andy Jassy’s Day One keynote and the second keynote on Thursday. This category is where the most disruptive innovation is taking place and the fiercest platform competition is occurring. AWS will feature enhancements or new offerings at four levels.

At a platform level, they are expected to highlight Ironman as a unifying layer to help developers ingest and organize data and then design, test and run intelligent (ML/AI powered) applications. This platform leverages MXNet, which is a machine and deep learning framework originally built at the University of Washington, which has properties similar to Google’s Tensorflow framework. Ironman will leverage a new developer tool framework called Gluon that AWS and Microsoft recently launched.

At a core services level, AWS will continue to enhance AWS ML services and infrastructure processing services like GPU’s and FPGA’s that support the data scientists who can build and train their own data models.

For teams that need more finished ML/AI services, AWS will highlight improved versions of ReKognition, Lex and Polly. I also expect new finished services that leverage pre-trained data models the existing offerings to be announced.

The fourth area of ML/AI will be in the context of leveraging other services either built by AWS or AWS partners that deliver solutions to customers. AWS will likely focus on a combination of running cloud services (AWS, Non-AWS) as well as simplifying ML/AI at the edge. For example, third parties are increasingly building security services like Extrahop’s Addy or Palo Alto Network’s cloud firewall and SAAS security services on AWS. Other services using data stored or processed in AWS, often in data warehouses like Snowflake or Redshift, are rapidly growing for vertical markets and for specific use cases like customer personalization, fraud detection or health recommendations. Seeing what AWS and partners announce in ML/AI powered services across the platform, core services, finished services and solutions layers is likely to be the most exciting area of news at Re:Invent this year.

“Seeing what AWS and partners announce in ML/AI powered services across the platform, core services, finished services and solutions layers is likely to be the most exciting area of news at Re:Invent this year.”

Hybrid Workloads and Enterprise Agility Solutions

While there are pockets of enterprise innovation in ML/AI and “serverless”, the biggest areas of enterprise focus are going to be hybrid applications and enterprise solutions. These areas also highlight some intriguing partnerships between AWS and other technology companies like VMWare, Microsoft and Qumulo.

Last year AWS on VMWare announced a major partnership where AWS created a dedicated, “bare metal” region for VMWare hypervisors, management tools and more running on AWS. This offering has been in beta all year and appears to be gaining strong enterprise traction. It simplifies moving VMWare-based workloads to AWS and enables hybrid workloads when a portion is on AWS and another portion remains on-premise. Customer examples and new capabilities will likely be announced for this partnership. We don’t expect major announcements around bare metal offerings outside VMWare, but enterprise customers are asking for them to be launched in 2018.

While AWS and Microsoft compete for cloud customers on many levels, there has also been a spirit of partnership between the two companies driven by both enterprise customer demand and competitive realities. Microsoft Windows operating system and applications (SQL Server, ActiveSync Directory, Sharepoint and more) are common applications on AWS in addition to their substantial on-premise installed base. AWS is increasingly enabling their defacto cloud standards like S3 object store and EC2 compute instances to run on-premise. AWS has a service called CodeDeploy that enables EC2 instances to run on-premise or for hybrid workloads (https://aws.amazon.com/enterprise/hybrid/). This enables AWS standard services to work with other Microsoft products on-premise. These examples highlight the growing customer demand for hybrid workloads and services across public cloud and on-premise. And, combined with services like Gluon and the Amazon/Microsoft Voice Assistant partnership, the two Seattle-based technology giants are finding ways to work productively together (often to counteract Google).

Beyond the technology giants, smaller companies like Qumulo will be highlighting hybrid workload flexibility and use cases. Qumulo offers a universal, scale-out file system that allows enterprise customers to scale across on-premise and cloud infrastructure. Technology sectors such as storage where Qumulo is focused, application management where New Relic, DataDog and AppDynamics run, along with databases and security and networking will all see “hybrid” highlighted at Re:Invent.

Beyond individual services and workloads, enterprises continue to look for solutions that help them embrace the agility and cost-effectiveness of cloud computing while mitigating the technology and compliance risks and skill-gaps they may face. AWS will continue to highlight their own professional services as well as a cloud-native solution providers like 2nd Watch and Cloudreach and established “systems integrators” like Accenture and CapGemini. But, I expect AWS will emphasize the growing role of the AWS Marketplace this year as a place to find, buy, deploy and bill first and third-party services from. Finally, more software services will be delivered on AWS in a “fully managed” mode. These modern “managed software services” like the aforementioned cloud data warehouse, database/datastores or storage services will help enterprises embrace cloud native applications.

Balancing Customer Focus with Competitive Realities

All four above themes are driven by customer needs and real technological innovations. But, there are also embedded competitive realities across these themes. Microsoft’s Azure adoption continues to grow rapidly. They have also successfully moved customers to Office365 pulling key services like Azure Active Directory and mobile device management with them. In addition, Microsoft is leveraging their on- premise advantage with hybrid solutions and Azure Stack. These offerings help enterprises embrace agility while cost effectively managing legacy hardware and software. Microsoft also continues to invest and promote their ML/AI and serverless capabilities.

Google has emphasized their ML/AI strength with both the Tensorflow open source adoption as well as leveraging differentiated data sources to build and offer data models “as-a-service”. These image, translation and text recognition models have the opportunity to be strategically disruptive for years to come. Of course, Google also operates broadly adopted cloud apps like Gmail and Google Docs where AWS does not. And, the defacto standard for serverless container orchestration and management, Kubernetes, was created inside Google.

These competitors, as well as other enterprise software and hardware incumbents like Oracle, VMWare/Dell, IBM and Salesforce.com and emerging Chinese competitors like Alibaba will continue to invest and challenge AWS in the years ahead as the enterprise gets more fully engaged in the cloud. While I am confident that AWS will remain the clear market leader for years to come, even they will need to continually “re:Invent” themselves to meet growing customer needs and competitive realities. I will be looking for clues about AWS’s future strategy and approach to emerging competition this week.

Note: Extrahop, Qumulo, 2nd Watch and Snowflake are portfolio companies for Madrona Venture Group, where Matt McIlwain is a Managing Director.