One year ago I took advantage of a rare opportunity by accepting a ‘growth role’ at a venture firm. My job is to help our portfolio companies grow and this has given me a unique vantage point to witness the difference between successful and unsuccessful companies when it comes to growth marketing.

One thing that surprised me is that there is so much in common even when looking at companies at different stages or with different types of customers. Closely monitoring cohorts, for example, has proven to be just as important at a B2B company like Smartsheet as it has been for a company selling to consumers like Rover. An attribution system that links pre and post-purchase data is crucial to the success at a mid-stage company like Bizible just as much as it is at a later-stage one like Redfin.

Here is more information on those two and other lessons I have learned both from the Madrona companies I partner with as well as my prior experience in growth roles at zulily, Microsoft, and Blue Nile:

1. Invest in Data Collection Early On

A common mistake I see is when a company implements the basic version of Google Analytics and thinks they have their analytics needs met for the foreseeable future. While that approach may help spot some high-level directional trends, it does not allow a company to identify micro trends that can be catalysts for future growth. While at Microsoft in charge of selling subscriptions to Exchange Online in the pre-Office365 days, we invested early in a data warehouse and were able to dive into pageview and purchase behavior to identify the content with the highest conversion rate. Using our data warehouse, we found that a particular case study was 5x as correlated with buying vs. other types and promoted it more heavily as a result. The good news for marketers today is that there are analytics tools available that can be setup much more quickly and affordably than in the past. I am a fan of both Segment and Alooma for event tracking / data pipelines and Redshift as a data platform.

2. Link Pre and Post Customer Data

Many people are surprised to learn that at zulily we had a CAC target in one program that was 50x as high as a target in another. For a time, both were a part of our mix as we could use them to acquire customers for less than they were worth. The reason we could operate this way is that each ‘member’ we acquired was tagged with specific details about where they came from enabling us to monitor their value throughout their lifetime. We did this not only at the program level, but also even more granular like by keyword in paid search. Where I’ve seen companies miss in this area is having a uniform CAC target. In the zulily example, that would have likely resulted in overpaying for the lower-quality traffic and eliminating the higher-quality one. SaaS companies I work with are able to do similar as they can see the traffic sources for buyers and then see which of them led to the stickiest and most satisfied customers over time. Often times programs that are more expensive end up being the stronger performers over time as the long-term customer value is greater than other programs that can deliver cheaper initial customers.

3. Look at Cohorts in Multiple Dimensions

Looking at customers in cohorts is a great way to measure performance and it is great to see an increasing number of companies doing this. Cohorts can be especially valuable in businesses with high repeat or engagement rates as well as subscription companies that need to closely monitor churn. When I do cohort analysis myself, I like to look at two different styles: time-based and behavioral.

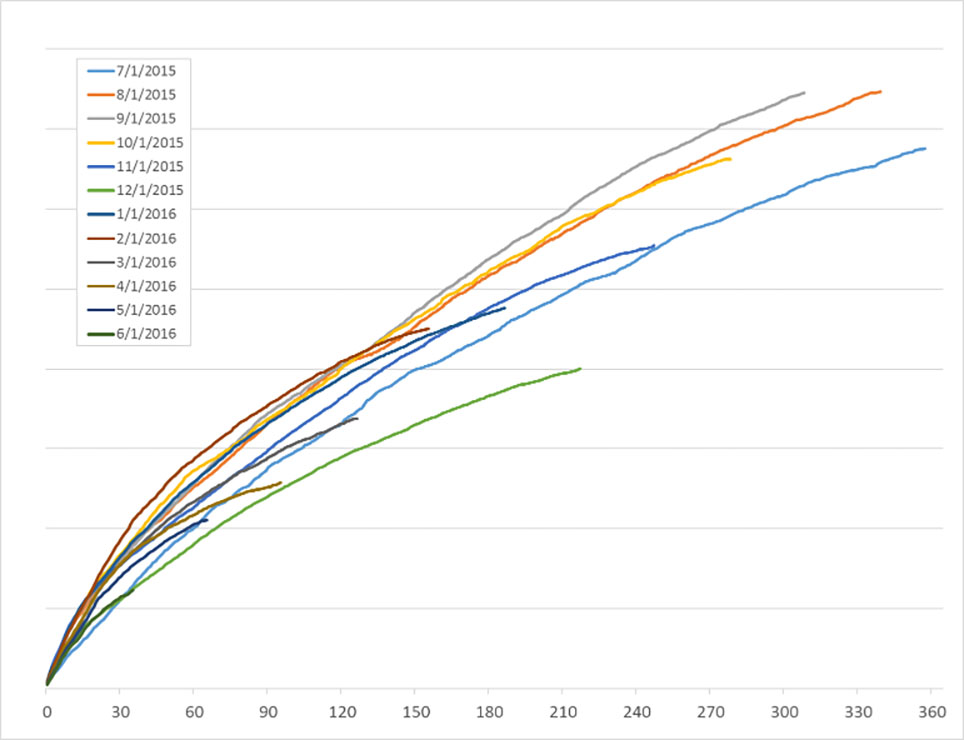

A time-based cohort chart like the one below shows the cumulative value of customers based on the time they were acquired. This type of analysis lets you compare groups to see if they are getting more or less valuable at comparable points in their tenures. In this case, you’d notice a few weeks in that the December 2015 was under-performing:

time-based cohort measuring cumulative demand over time

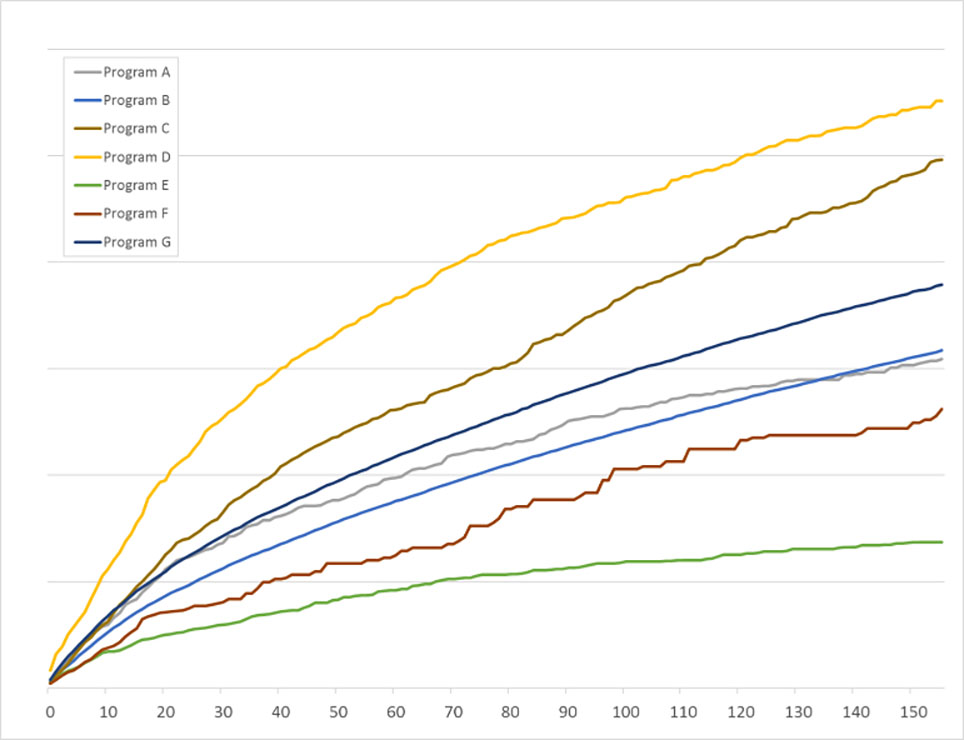

Behavioral cohorts normalize for time and instead look at different characteristics of customers. A few examples of this type are: whether customers came from paid or unpaid sources, which customer segment they belong to, or which device they signed up with. In the chart below, you’ll see values across different programs — let’s hope ‘Program E’ were very inexpensive to acquire!

behavioral-based cohort measuring cumulative demand of different segments

High-performing companies look at both of these styles often. One of our companies, ReplyYes, noticed in their time-based cohort view that a recent month was trending lower very early on in their tenure. They then looked at a behavioral-based cohort and noticed that a new segment they had been experimenting with was not as valuable as their traditional customers. They quickly made optimizations and saw future cohorts look better as a result.

4. Think of Growth as a Cross-Functional Effort

One of the benefits of tech businesses is the speed of iteration that can be possible. A company can launch a test, see the results, and iterate until they identify a statistically-significant improvement to a key metric. Where this falls down is when all of the steps in this process fall on the shoulders of a single individual (often a head of marketing). A better approach is to look at opportunities like this cross-functionally where developers, UX designers, product managers, and marketers work together toward a shared growth goal. New landing pages and onboarding experiences in particular can lead to step-change style improvement and are most successful when multiple disciplines contribute their complementary strengths.

5. Don’t View Marketing Programs in Silos

With all of the noise in the marketplace, acquiring and retaining a customer can be a very complex system with many unanticipated consequences. Rapidly increasing the quantity of leads can lead to a decrease in the customer experience and effectiveness of retention programs. Increasing the scale of one acquisition program can have significant impacts (both positively and negatively) on other acquisition programs. For this reason, the most effective companies start with what I call a ‘universal source of truth’ metric (like new customers or total revenue) and work backwards to see which programs and tactics are contributing to it.

A common misstep on the acquisition side is to look at pixel-based conversions in individual programs. Individual marketing programs can appear to be hitting ROI targets when doing this even when the overall business struggles because of double or triple-counting the same conversion. A common pitfall I see caused by this approach is over-investment in retargeting programs that look fine in isolation but often times do not when looked at more holistically. To avoid this, start with the total orders or customers and don’t be afraid to A/B test retargeting in particular to see its true impact.

6. Understand ‘Pull’ and ‘Push’ Customer Acquisition Programs

An exercise I like to go through with companies is to classify their acquisition programs based on the customer mindset at the time someone learns about their offering. Doing this tends to group programs into what I call ‘pull’ and ‘push’ marketing. Pull marketing is when customers know about the category and actively seek out solutions on by asking their friends / colleagues or by searching on Google or a vertical-specific directory. Push marketing, by contrast, is when customers are doing other things, but learn of an offering because it is ‘pushed’ to them (like in a newsfeed). Many companies are able to succeed with both types, but typically one will be dominant.

A service or product where most of their marketing is ‘pull’ will often have lower margins. Here it is important to focus on things like page load time and testing different parts of the funnel as small improvements can have a large impact on performance. Alternatively, when ‘push’ is dominant, storytelling becomes more important which increases the need for a strong PR presence as well as high-quality ad copy and landing pages. Even if you are growing nicely due to success in one style, I still find it valuable to keep testing both as a healthy mix tends to lead to the best outcomes over the long run.

7. Explore Offline Channels

Though most people I work with allocate the majority of their media budget to online channels, I see many of the faster-growing ones having some success offline. Succeeding with offline channels will require flexibility when it comes to attribution, but the cost can be lower and it can be a good way to stand out from what can be noisy and competitive online channels. Apptio in our portfolio has succeeded with direct mail and at one time it made up a quarter of their pipeline. On the consumer side, Indochino has been having success with podcasts and at zulily we scaled up quite a bit with TV advertising. If you decide to test offline programs, keep in mind that they can be slower to get started and have higher initial testing budgets compared with online programs so be patient and plan ahead.

8. Be Careful of Unrepresentative Early Customers

As I noted earlier, it is important to invest in analytics early to best understand how customers are reacting to your product or service. An important second piece of this is to make sure that early customers are representative of the types that you will see later on at larger scale. I have seen this lead companies astray when a disproportionate number of early users come from people they already know. An audience of your friends and family can react much differently than a more general audience, so I recommend that companies have a mix of paid and unpaid even in the early days. Doing so and comparing performance across different segments (like in #3) will help you understand how users are reacting in more predictable ways.

9. Don’t Assume Program Performance Will Scale Linearly

Hearing about a new successful acquisition program is one of my favorite parts of my job, but I’m careful to tell marketers who have found something not to be complacent. Problems can arise when people believe performance will continue at the same rate into the future and at greater scale. Increasing competition can cause performance to suffer in addition to declines caused by reaching larger and less-targeted audiences once campaigns get larger. Rather than assuming initially strong performance will continue, I recommend taking a more cautious view that individual programs will get harder and more expensive at greater volume. Doing so will lead to fewer surprises down the line and should also encourage people to stay hungry for new programs.

10. Be Open to Different Levels of Experience in Growth Leader

There is no clear date for when the era of growth marketing began, but many point to 2012 when Sean Ellis coined the term ‘growth hacker.’ Facebook is used as an early example of some of these principles in action and it opened its membership beyond college students only in 2006. Since we are now in 2016, it pains me to see when companies seek out someone with 10+ years’ experience to run their growth team. People who are curious, analytical, fairly technical, and can work cross-functionally tend to be most successful in growth roles and I have found those qualities in people with a wide range of experience levels.

This list is only a start as growth marketing is a rapidly-changing field that is only just beginning. I’m excited to learn more about the successful growth strategies that emerge and whether they fit into this list or are completely different.