The secular shift from physical to digital commerce was well underway before the global pandemic. What we have seen in the past six months is an acceleration of this trend which is further blurring an already blurred line between the two.

When retail stores were forced to close, brands like Lululemon turned their physical stores into fulfillment nodes for their online business, with store employees coming in to pick, pack, and ship from store inventory. At retailers like Target and WalMart, curbside pickup and store-based delivery quickly became mainstream ways for customers to shop. At grocers like Kroger and QFC, Instacart and grocers’ own shelf-picking and delivery services overlaid digital transactions on physical commerce infrastructure. There is no question that the shift we have seen in 2020 will create opportunities for years to come, both in accelerating more transactions from physical to digital and in leveraging the existing physical retail infrastructure to support digital use cases. These are markets where Madrona has been investing for 25 years, and they continue to be focus areas for us. The commerce-related investment themes we talked about in 2019 are increasingly relevant today. This post updates our thinking on how retail is undergoing a significant shift – and outlines the areas we think are ripe for innovation, and for investment.

Digital+Physical

As we think about the intersection of the digital and physical more broadly, the shift of in-person experiences to remote/digital has been accelerated by the global pandemic. From ceremonies and celebrations, to social outings to health visits and entertainment, the activities we once felt (very strongly!) could only happen in-person are shifting online. Initially this was out of necessity, but over time we believe online will be a significant portion of the market, as the quality and convenience are demonstrated and becomes socially acceptable. In this post, we’ll cover four markets where this dynamic applies: Telehealth, Shopping (product discovery), Fitness, and Entertainment.

Fitness and healthcare are markets where we’ve been tracking the shift from in-person (physical) to digital and have been hunting for opportunities. Live (in-person) entertainment and product discovery (a subset of the offline shopping experience), are newer verticals where we are beginning to see or expect to see major shifts of attention and dollars to digital. We believe there are compelling opportunities for new companies to be built and existing companies to accelerate growth and share across all four markets.

Telehealth

As we have been unwilling or unable to visit our doctors’ and medical professionals’ offices during Covid, large segments of the medical industry have been forced to shift to a digital-first mode of care. This means seeing and understanding patients via high fidelity video, connected sensors, and other technologies to triage and diagnose potential issues as well as perform on-going monitoring and support.

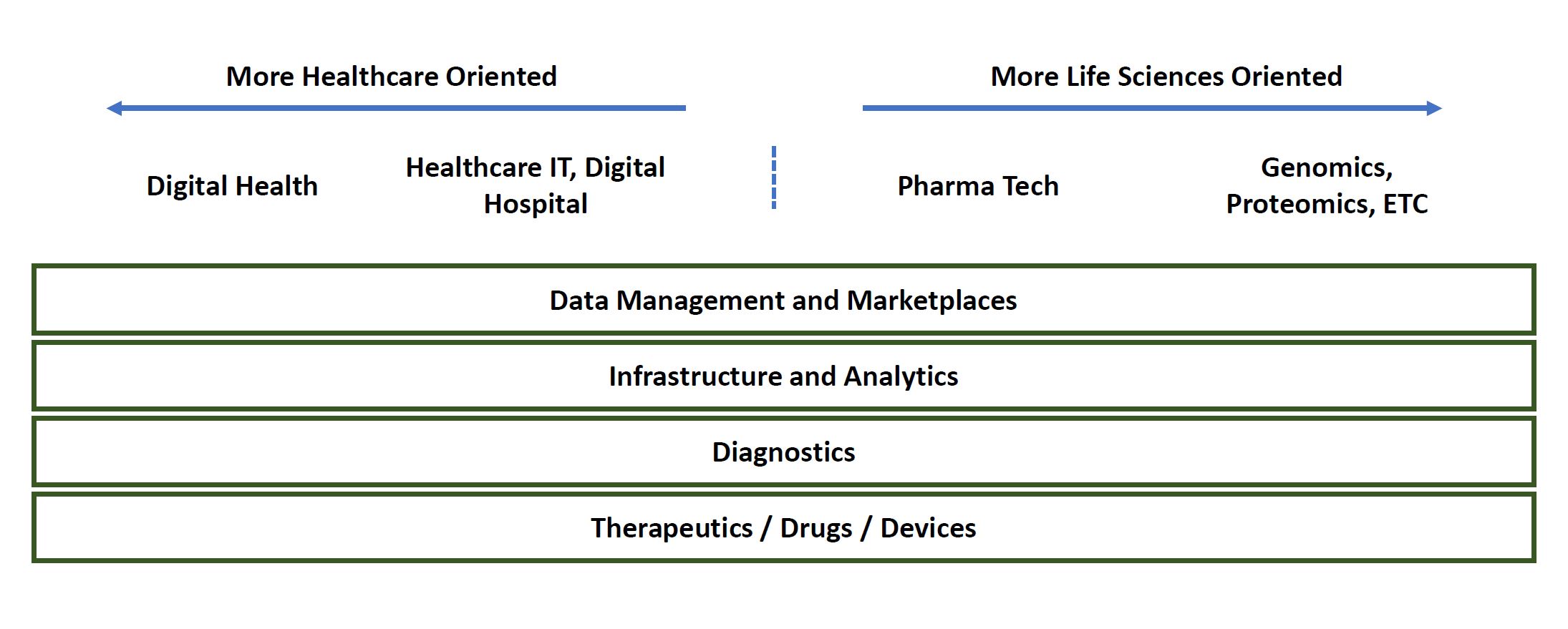

The magnitude of this shift and the opportunity it creates cannot be overstated. The healthcare market is enormous: US total market size in 2019 was approximately $2.7 trillion. If you strip out hospital care, pharmaceuticals, and nursing/home health, you’re left with about a $900 billion health services market. We believe a large portion of this $900 billion can ultimately be delivered remotely through digital means.

One vertical where we believe there is opportunity for multi-billion dollar businesses is mental health. Approximately 46 million Americans report having mental health issues, with only 43% of those reporting having received treatment. A recent survey of therapists found that during Covid, 75% of therapists had shifted to digital-only therapy sessions while 16% were doing a combination of digital and in-person.

Mental health is a compelling category for a number of reasons. First, both 1:1 and group therapy sessions can translate well to video. Second, by relaxing constraints like geographic proximity between patient and therapist, scheduling is easier, more patients can be served and no “office” means lower overhead and lower cost of care. Additionally, for the youth segment of the mental health industry where conditions such as anxiety and depression are skyrocketing, digital is a seamless and native means of communication. Finally, industry studies, while early, suggest parity in effectiveness of in-person and virtual mental health therapy delivery.

The structural challenges around areas like insurance reimbursement/coverage and HIPAA compliance will be resolved over time — we have seen many fast-tracked solutions and progress in recent months — and it’s likely that the ultimate model of delivery for mental health will be a hybrid of in-person and digital. But the prospect of a digital-first delivery method for health services in general and mental health services, specifically, is a compelling opportunity for health consumers and the industry overall. It’s still very early days for companies being built in this category, but there’s no shortage of opportunities for innovation around technology, customer experience, and business models in the delivery of digital/remote mental health services into the mainstream.

Product Discovery (Shopping)

Much of the magic of physical in-store shopping is how it enables discovery, learning, and commerce in a single place, with the core ingredient being people. We find expertise every time we go to the store. For example, want to start a vegetable garden and don’t know where to begin? Head down to your favorite specialty garden shop or big box home improvement retailer to get advice from an expert. Need a new pair of running shoes, but you aren’t sure which ones work best with your running style? Head down to the specialty running store and they’ll ask some questions and watch you run. Want to take the kids camping but have no idea what you need? Head over to REI and an employee will outfit you head to toe based on the trek you will be taking. Physical retail is magical because it combines the expert knowledge of the human working at the store with the transaction itself. Conversely on the web, while there is no lack of content and inventory, the process of discovery, learning, and aided purchasing are broken. For example, Amazon has a massive amount of content but it’s not really a good place to discover new products or get expertise in a given category. Even the websites of the specialty retailers with incredible product and category knowledge really don’t get the job done – because those businesses are still oriented toward the in-person expertise model.

In a world in which we are taking fewer trips to the retail store, and the core physical retail business model is in peril, it begs the question: How do we create the digital analog of a more complete shopping experience? How do we bring the wealth of retail employee expertise and experience online? At Madrona, we see this as a big opportunity and believe that successful solutions will offer a magical combination of discovery, learning, and commerce (with a bit of entertainment), built into a highly integrated and seamless customer experience.

What does this look like? We’re not sure we’ve seen it yet, but we have a few ideas as to where there is opportunity for innovation. In the legacy experiences category, TV shopping through networks such as QVC and HSN is a great example. Discovery is core to that experience, with a curated set of products found all over the globe by the QVC/HSN sourcing teams as well as a host who walks viewers through the features and benefits of products with finely honed sales pitches, informed by data, to get you to purchase. “Buy now!” has shifted significantly from a phone number to navigate to the URL, but there is a direct call to action and connection between the content and the commerce. QVC/HSN did $11 billion in TV-driven retail revenue last year … while not the size of Amazon, it is a significant business. We think someone ought to re-invent HSN/QVC for the digitally native buyer.

Two new experiences we find fascinating were built outside of the U.S. market, but portend opportunities anywhere. One is ShopShops, a Chinese e-commerce company that uses live video to help domestic Chinese consumers shop retail shelves for the hottest brands in L.A., New York, and Miami (and soon, many other places). Like QVC, ShopShops hosts showcase merchandise and provide a curated retail experience, but they do so in partnership with physical retailers and brands, bringing products and knowledge together, and providing an integrated way to buy. In a world in which consumers want to see what’s new, but don’t want to venture out to the retail stores themselves (or the retail stores are halfway around the world), this is a novel concept that uses existing retail infrastructure and live video to enable discovery, learning, entertainment, and commerce, all over the world. Another is BulBul, an India-based company that enables anyone to build a live streaming channel through which they can promote and sell products. This is sort of like a crowdsourced QVC; instead of a managed production, BulBul is a marketplace model. We know that marketplace models don’t always deliver pristine customer experiences but leveraging the expertise of the crowd for any product category is an interesting idea.

We believe that elements of all of these can drive the translation of the discovery, learning, and commerce that happens in-store to a digital experience.

Fitness

While previously large group fitness classes were a popular way to get a workout and be social, these classes have been replaced with home gyms and outdoor workouts since Covid started. Even 1:1 sessions with trainers, which typically take place in gyms with shared equipment, have faced similar declines due to the nature of the in-person fitness environment. The market for individual and group training is enormous. The quality of the instructor and their ability to motivate you, watch your form, and give feedback is easy to do in-person. Showing up for the other members of your class and encouraging each other to achieve your goals is also effective in-person. So, how do these translate digitally?

Peloton demonstrated (prior to Covid, but also acceler ated by Covid) the effectiveness of designing a digital experience around and into a physical piece of equipment – the spin bike. We’ve seen from Peloton and others the extension of this model of incorporating live instruction and community into other pieces of equipment such as the treadmill, the rowing machine, the multi-trainer, and even the gym mirror. Some of these hardware-centered models will work, although being first to market is key because it’s unclear how many Peloton-like offerings can exist (both literally and financially) in a given household. It may be that, like in the wearables market, there’s one new category creator (Fitbit) and some large incumbents (like Apple) who build or buy their way in, leveraging their power of product development, marketing, and distribution.

ated by Covid) the effectiveness of designing a digital experience around and into a physical piece of equipment – the spin bike. We’ve seen from Peloton and others the extension of this model of incorporating live instruction and community into other pieces of equipment such as the treadmill, the rowing machine, the multi-trainer, and even the gym mirror. Some of these hardware-centered models will work, although being first to market is key because it’s unclear how many Peloton-like offerings can exist (both literally and financially) in a given household. It may be that, like in the wearables market, there’s one new category creator (Fitbit) and some large incumbents (like Apple) who build or buy their way in, leveraging their power of product development, marketing, and distribution.

But… is equipment-centered the only opportunity to deliver a digital one-to-one or one-to-many fitness experience that both lives up to its analog/in-person counterpart, and provides a compelling business model? We believe no, and that there is a lot of room for this market to grow.

Entertainment

Professional sports are coming back (kind of) … but without fans in the stands. The business model for live professional sports has a huge in-person component: ticket sales, parking, in-venue merchandise sales and concessions comprise a huge percentage of professional sports revenue. But the other big component for professional sports is broadcast revenue, which exists with fans or without. While broadcast revenues won’t make up for the shortfall from in-venue experiences, professional sports will find a way to survive. The movie industry should hold up alright as well (although perhaps not the theaters), as new movies go straight to over-the-top and subscription video services.

But what happens to other in-person entertainment experiences without an existing broadcast or video component and revenue stream? Theater, comedy, and music all depend heavily on ticket sales and ancillary revenues generated from in-venue and sponsorship experiences.

We are particularly interested in professional music given the sheer magnitude of the market. Live Nation / TicketMaster is facing an existential threat with revenues down a whopping 98% at the end of June 2020 as compared to the end of June 2019. The market needs radical rethinking on how to diversify and move part of the consumer experience to digital. Over the past few months, it has become clear that Live Nation and Ticketmaster’s strategy is to wait-it-out instead of putting serious resources into digital. Why isn’t the music industry doing more to drive innovation in content delivery and business model innovation for live experiences?

An argument we’ve heard from several in the industry is that certain elements of the live concert experience simply don’t translate to digital. The group of friends you go to the concert with, the pre-party in the parking lot or at the bar or restaurant, buying and wearing the shirt in-venue, singing back the song as part of the crowd, the energy of thousands or tens of thousands of bodies swaying to the music, the production of the show itself. The sounds, the smells, the experiences in-venue simply can’t translate to digital, and we shouldn’t try.

While we think there’s some truth to that argument, we also think there is opportunity for new digital experiences to be good enough to at least capture some of the massive market at stake. The show must go on for artists to survive and sponsors and brands are searching for ways to reach an audience during the current live events vacuum.

Is there an opportunity to translate live music experiences to digital with a monetization model that works? We believe there could be, and that it’s going to take a lot of experimentation and innovation to figure it out. “Twitch for live music” probably isn’t going to work (just to use an analog; this is not a critique of Twitch). There’s some interesting experimentation with virtual concerts, including leveraging artists’ distribution (e.g., Travis Scott on Fortnite). There’s live video on Instagram Live and sites like LiveConcertsStream, and, of course, there’s always Zoom’s video conference platform which can be repurposed for events like these. But do we sell tickets, or do we accept tips? Do artists perform from their homes, or use small studios and production venues with high fidelity video and sound? Sports like boxing have found a way to meld an in-person experience with a remote (TV) experience, where pay-per-view revenue is a larger source of revenue than in-person revenue. Can pay-per-view (or something like that) be additive to the live music model?

In Conclusion

Now is the time for experimentation and testing, not just for music, but for all of these categories. We are excited to see new business models that bridge the digital and physical world and enable new experiences along the way. From fitness to music to shopping to mental health, the opportunities to build are endless and we are eager to meet entrepreneurs innovating in these categories.