Every VC-backed company board gets to evaluate company exits from time to time and often these decisions occur when there is an opportunity to raise more capital. If you have been in the industry for a while, you have experienced various forms of the three main types of late-stage capital raises or exits: Late-stage rounds, IPO, and strategic M&A. Late-stage rounds are an interim step for raising capital and forging a path to profitability. M&A is usually appealing to all shareholders only when the company is being “bought and not sold.” Finally, IPO’s are expensive and hard to prepare, and public capital market timing and attractiveness are out of any board’s control. So boards are sometimes unsatisfied with the alternatives available for capital raising and/or transfer of some or all corporate control.

In the private equity world, a fourth option has existed for many years where one PE firm buys out the majority stake of another PE firm that is ready to sell. Increasingly, PE firms are making this “secondary buyout” option available to VC-backed companies and their boards. These “VC-to-PE buyouts” are a helpful liquidity alternative for both employees and investors in later-stage VC-backed companies and are changing the dynamics when boards consider strategic options. Specifically, we have seen software-focused private equity firms like Vista Equity Partners (Ping Identity, Marketo) and Thoma Bravo (Digicert, Qlik) in the market, looking to acquire both private and public software-driven companies.

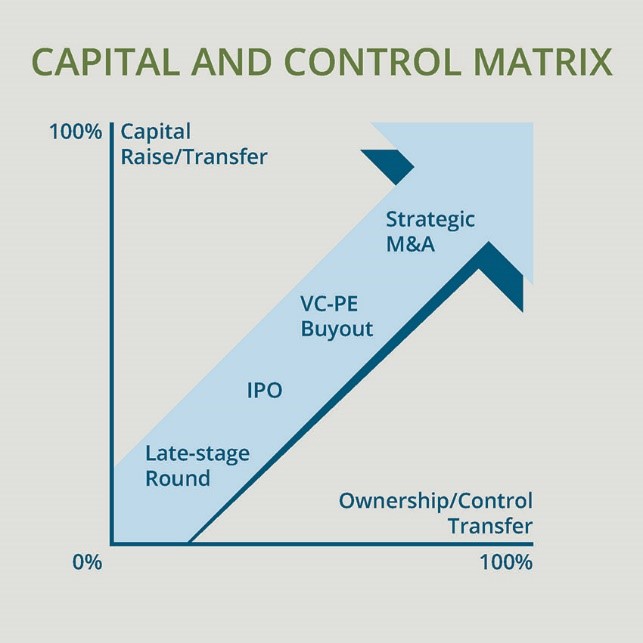

Capital and Control Matrix

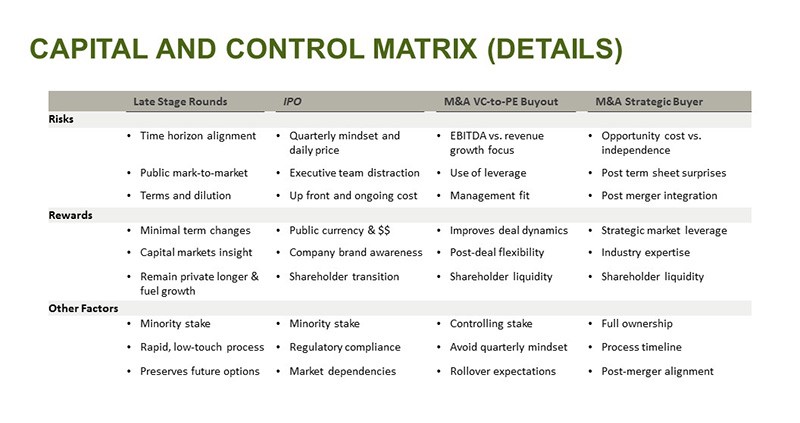

Capital raising strategies and corporate control questions are among the most momentous ones for a company board. These are often areas where the collective experience of the board can provide great value to an entrepreneurial team. At times, the capital raising and control questions can become conflated. Below is a high-level summary of the options available to later-stage, venture-backed companies arranged by percentage of capital raised/transferred and percentage of control/ownerships transferred. A more detailed matrix is included at the end of this piece.

How Did We Get Here?

For the last several years, late-stage capital for private companies has been plentiful, relatively inexpensive and light on control provisions and investor protections. While there have been occasions of sudden and sharp pullbacks, including February 2016 and April 2014, this capital has generally been available for high-growth companies. An increase in the size and variety of sources of capital, from larger venture funds, public institutional investors and hedge funds, have fueled these “company-friendly” trends. These capital sources have allowed companies to remain private later and longer than historically possible, and have given rise to the so-called “unicorns”, or private companies with valuations above $1 billion.

Two main groups of investors look to lead late-stage private rounds. One group consistes of late-stage venture firms like Insight and TCV who prefer to take market execution risk over the product market fit and market timing risks taken by early stage VC’s. The second group is mostly made up of public stock investors like T. Rowe Price, Fidelity and Janus, along with some hedge funds. For rapidly growing, technology companies, these private rounds are often attractive. Companies sell a small portion of their business in exchange for growth capital and the later stage company-building expertise of new investors. These rounds sometimes have a secondary component to provide some liquidity to longstanding employees and early investors. With these private rounds, companies are somewhat sheltered from the quarterly expectations of the public market, which is especially helpful for companies who have customer concentration, lower sales productivity and lumpy sales cycles.

A different path for raising capital and creating liquidity over time is the IPO. A company sells shares (typically 15 to 20% of the company at pricing) to raise capital to fuel growth. The IPO process is expensive and time consuming, generally costing over $3 million to prepare and taking 9 to 12 months. And, being public subjects a less established company to the spotlight and expectations of public company investors. That said, for companies that are taking a long-term perspective and are increasingly mature in their processes and predictability, an IPO has several advantages. It creates a public currency that can be used to buy other companies or leveraged to raise more cash by taking on low-cost debt. An IPO provides a path to liquidity for existing employees and investors, as well as a path for transitioning ownership from early-stage to public company investors. The IPO also has some other advantages; it creates a branding opportunity for the company and a stamp of approval in attracting customers, partners and new employees.

In a world of Software-as-a-Service (SaaS) and subscription-based businesses, companies are stronger candidates for being public. They have greater visibility into key metrics like revenue, product usage, customer renewals/upsells, customer acquisition cost and lifetime value than was ever possible in a world of on-premises and licensed software. And, they can typically drive toward free cash flow and positive operating margins as they get to scale and continue to invest in growth. For these reasons, we expect more of the mature SaaS and subscription-based technology companies to go public if the IPO market stabilizes in the later portion of 2016. But, the demands of being public, the volatility in capital markets, and the leverage of gatekeepers in the IPO process have led many boards to choose other paths.

M&A and the new VC-to-PE Buyout Trend

Selling a company in an M&A process is another path. But, according to Pitchbook, full-year 2016 transaction value is projected to be well below the $83.9 billion dollar of M&A reported in 2014. This trend is especially surprising given that five of the largest technology companies (Apple, Microsoft, Alphabet, Oracle, and Cisco) had $504 billion dollars of total cash in May 2016 and, financial sponsors have over $1 trillion of “dry powder” available to invest. Notwithstanding the recent acquisition of LinkedIn by Microsoft, NetSuite by Oracle, and EMC by Dell, larger technology companies have been relatively cautious to make medium to large acquisitions.

What we have seen emerge over the past few years, is a group of discerning private equity firms including Vista Equity, Thoma Bravo and Warburg Pincus who have sensed opportunity and increasingly led the way on initiating M&A discussions and acquiring VC-backed, software companies. For the same reasons that mature SaaS companies are less risky to take public, they are better able to fit within a leveraged buyout model. Boards of later-stage private companies are evaluating these VC-to-PE buyouts as an alternative to strategic buyer acquisitions or raising capital in IPO’s or private rounds.

Several broader factors, that may not persist, are contributing to these current VC-to-PE buyouts. Valuations for SaaS companies growing 20%+ on an “enterprise value to next twelve-months sales” (EV/NTM) basis have recovered, according to Goldman Sachs; but are still modestly below the 5.5x EV/NTM 12-year average. The cost of debt remains low, and more innovative debt structures are available. Finally, in some cases like Marketo (a public company example where more data is available), the EV/NTM multiples paid by private equity buyers outbid potential strategic buyers. The Marketo deal was done at a 64% premium to prior stock price with a 5.8X EV/NTM multiple. The company grew roughly 40% in revenue and billings in 2015, and generated $2.3 million of cash. In Madrona’s portfolio, the purchase of PayScale a few years ago was a leading indicator of this trend. With SaaS companies growing and maturing, other VC-to-PE buyout deals are expected.

But why would a VC-to-PE buyout be attractive to the management and board of a later stage private company? Management has the opportunity to continue fulfilling their dream as an independent and private company. New PE owners offer a high degree of autonomy and flexibility to executives who are meeting or exceeding agreed-to milestones (admittedly with greater EBITDA emphasis over growth), as well as additional capital to take advantage of strategic opportunities. These deals create immediate liquidity for long-standing shareholders. Typically, executives remain in their leadership roles and receive new equity in the new entity. The opportunity cost of a VC-to-PE buyout is the promise of holding out to build even greater value through an IPO or strategic exit. However, this new form of buyout could be considered the “best of both worlds” for a management team that is committed to continuing to build business and equity value.

A force as significant as VC-to-PE buyouts will likely have ramifications across the capital and control matrix. A few we anticipate are:

- Strategic buyers will be motivated to move more quickly and aggressively on acquisitions – and be pressured on pricing and terms as they look to acquire later stage private companies.

- We may see a loosening of the burden of the IPO process. Investment bankers, public equity investors and other gatekeepers will become more flexible on IPO pricing and processes in taking companies public.

- Later-stage rounds, for 20%+ growth companies that can demonstrate compelling unit economics and a path to cash-flow breakeven, will enjoy a rebound in company-friendly pricing and terms and will continue to offer partial liquidity for employees/investors.

- PE buyout firms will increasingly emphasize the “best of both worlds” value proposition to CEOs and their executive teams as a reason to choose the VC-to-PE buyout route.

Boards are responsible for helping guide management teams to maximize long-term shareholder value in the context of balancing risk and reward. The increasing opportunity for later-stage companies to evaluate VC-to-PE buyouts as a change of control option improves the menu of possibilities boards can consider. Thinking about it in matrix form can help clarify the real trade-offs between options leading to better capital raising and control decisions.

This post first appeared on Venturebeat in shortened format.